Millennials Who Bought Houses Before COVID Won The Lottery — And It Feels Like There's No Hope For The Rest Of Us

Hi, I'm Morgan! I live in an apartment, but I started saving for a house in 2019 (the year I graduated from college). One of my biggest dreams was to give my puppy-son, Dandelion, the backyard he deserves.

Sadly, I've given up on that dream at 30 years old. Here's why:

Since the early days of the pandemic, housing prices have absolutely skyrocketed. Those of us who hope to own simply cannot save enough to keep up — unless you make an extraordinary income as a doctor, in tech, etc. By and large, the middle class has been shut out of the real estate market.

In June of 2019 — exactly five years ago — Redfin released a report stating the median American house price was $315,700. With an average interest rate of 4.13%, the monthly payment came out to $1,225 (not including property taxes, HOA fees, and insurance, which vary wildly by location). But according to a recent Redfin press release, the median house price is now $416,623. With today's average interest rate of 7.18%, the monthly payment totals $2,258, once again not including taxes and fees.

That's already an increase of $1,033 per month — but insurance rates, groceries, daycare, and pretty much everything else has also jumped up during this time, making it even harder for young people and new families.

Unfortunately, my family lives in Orange County, California — one of the most expensive locations in the country. I would've loved a house in OC because family is really important to me, but according to Zillow, the median listing price is a whopping $1,261,833. That means a 20% downpayment comes out to $252,367! Excluding taxes, fees, and insurance, we're already at a monthly payment of $6,838.

According to the California Department of Housing and Community Development, the median individual income in OC is $89,450, and the median household income for a family of four is $127,800.

Obviously, it's impossible for a median-income person or family to be approved for a loan nowadays. But in 2019, the average OC price was $735,500. Home prices increased $526,333 in just five years! Before COVID, the odds might've been stacked against you, but with enough years of saving and hard work, you might've gotten lucky enough to snag a house. Now? There's no hope at all for the middle class.

Folks have a lot of thoughts about the root causes of all this: NIMBYs (Not In My Backyard) who oppose affordable housing, mom-and-pop investors, large investment firms, zoning laws, builders not building enough starter homes, etc. I'm not an expert, so all I know for sure is the end result: being priced out completely.

People usually have the same response to aspiring first-time homebuyers in California: just move! And that's exactly what I did. In 2022, my boyfriend, Dandelion, and I moved to Austin, where housing is more affordable. Turns out, I'm a big baby and miss my family way more than expected. On top of that, there's not much of Pacific Islander community here, so that feels pretty lonely. While Austin is beautiful and a ton of fun, I want to move back to OC in a couple years.

I feel like I'm being forced to choose between community and housing, and that's not right. I grew up in OC — went to school, worked, and paid taxes there. Why don't I get a shot at the American dream the way previous generations of OC residents did?

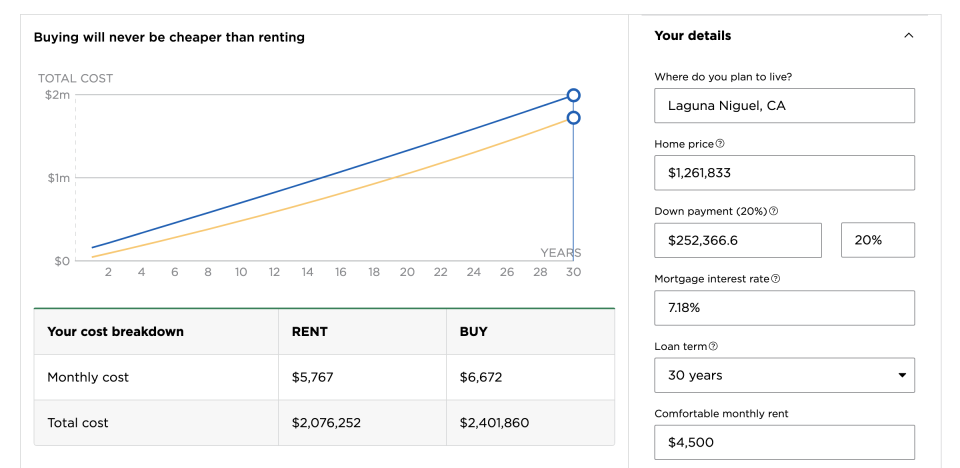

Now, some people argue that it doesn't make financial sense to buy in high cost of living areas at all. I used Nerd Wallet's rent vs. buy calculator and plugged in the median house price compared to a rent of $4,500/month (about what it would cost for a similar house). It says "buying will never be cheaper than renting," but it seems like the calculator only looks forward 30 years (the life of the loan).

So, during the 30 years you're paying off your mortgage, renting makes more financial sense. However, I keep wondering what the numbers look like after those years: if you need to move an elderly parent in with you, you get sick in your old age, or you simply retire. Rent has increased so much in the 8 years since I moved out that I shudder to think what it'll cost in 50 years.

If you hope to retire comfortably without owning a home, the answer seems to be maxing out your retirement accounts (IRA, 401(k), HSA, etc.) every year. But if I could do all that, I could probably afford a house, LOL. So again, where does that leave the middle class?

For the most part, people who secured houses pre-COVID scored the lottery. But for the rest of us? I'm not sure what the answer is. Even if I saved diligently for the next 10 or 15 years, homes still seem hopelessly out of reach. Dandelion might never get the backyard of his dreams, but he has the park near our apartment complex, and that'll have to do.

What do you think of the housing crisis? Is it better to rent or own? If you've been able to purchase a house in the last few years, how did you do it? Share your thoughts in the comments below.