Investors Who Bought S&W Seed (NASDAQ:SANW) Shares Five Years Ago Are Now Down 56%

It's nice to see the S&W Seed Company (NASDAQ:SANW) share price up 24% in a week. But that doesn't change the fact that the returns over the last half decade have been disappointing. The share price has failed to impress anyone , down a sizable 56% during that time. Some might say the recent bounce is to be expected after such a bad drop. Of course, this could be the start of a turnaround.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for S&W Seed

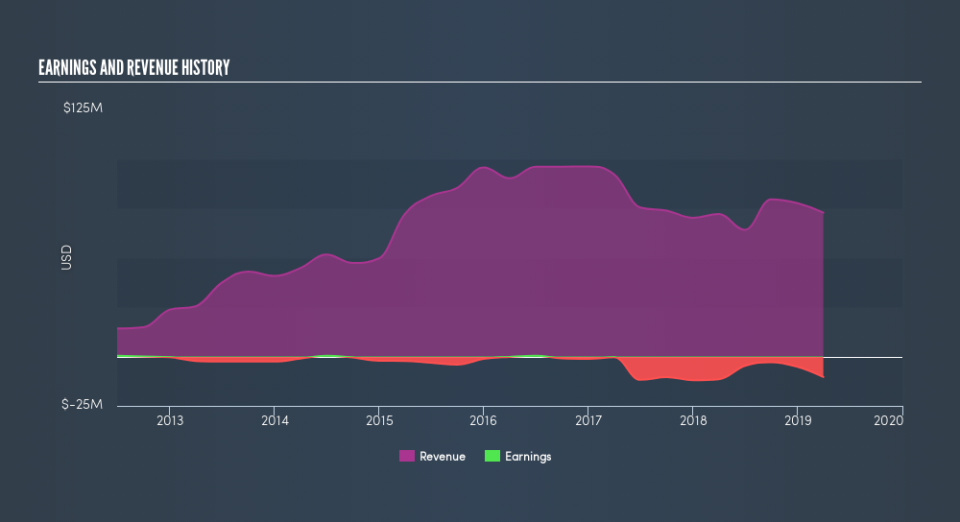

Because S&W Seed is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, S&W Seed saw its revenue increase by 4.9% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 15% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in S&W Seed. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in S&W Seed had a tough year, with a total loss of 16%, against a market gain of about 3.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 15% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: S&W Seed may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.