Mediocre Returns on Capital At General Motors (NYSE:GM) Aren't Supporting the EV Turnaround

This article first appeared on Simply Wall St News.

The transition from internal combustion to electric power is arguably the greatest transformation in automotive history so far.

Yet, transitionary changes often spark some problems, especially in a race against the clock to either capture or keep the market share.

General Motors ( NYSE:GM ) is just one in line of companies involved in this transition, yet it cannot catch a break between the short-term negative catalysts, from chip shortages to vehicle recalls.

In the wake of the latest news, we will examine how efficient is the company in using its capital.

Latest Developments

General Motors just announced additional recalls for Chevrolet Bolt . While the first one included 69k vehicles globally, the new one will add 73k vehicles in North America. This brings the total cost of potentially defective battery modules replacement up to US$1.8b.

Meanwhile, GM employees in Silao, Mexico, voted to reject the current collective contract , quoting low wages, poor workplace safety, and COVID-19 safety concerns.

Silao plant is responsible for the production of Chevrolet Silverado, whose electric version will feature four-wheel steering and 24-inch wheels. EV Silverado will be built on the Ultium platform that is used for EV Hummer.

Return On Capital Employed (ROCE): What is it?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business.To calculate this metric for General Motors, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

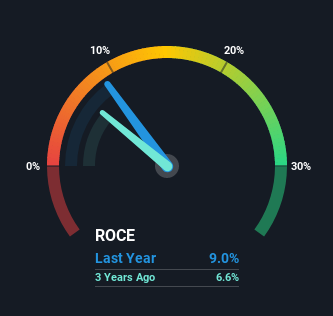

0.09 = US$15b ÷ (US$242b - US$75b) (Based on the trailing twelve months to June 2021).

Thus, General Motors has a ROCE of 9.0%. On its own, that's a low figure, but it's around the 9.8% average generated by the Auto industry.

View our latest analysis for General Motors

Above, you can see how the current ROCE for General Motors compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting in the future, you should check out our free report for General Motors.

How Are Returns Trending?

There are better returns on capital out there than what we're seeing at General Motors.The company has consistently earned 9.0% for the last five years, and the capital employed within the business has risen 24% in that time.This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

The Key Takeaway

In summary, General Motors has simply been reinvesting capital and generating the same low rate of return as before.However, the market remains somewhat optimistic because the stock has gained 81% over the last five years.

Yet, if the trajectory of these underlying trends continues, we think the likelihood of it being a multi-bagger from here isn't high, which is supported by all the problems currently weighing on the company.

Like most companies, General Motors does come with some risks, and we've found 2 warning signs that you should be aware of.

While General Motors may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com