DexCom (DXCM) Rises 7% in One Week: What's Driving It?

DexCom's DXCM shares have risen 6.9% since Tuesday last week, while yesterday’s after-market movement took the rally to nearly 8%. Last week, the company presented a positive picture for its continuous glucose monitoring (CGM) devices, allaying investors’ fears about rising competition from GLP-1 drugs like Wegovy, Ozempic and Mounjaro.

These GLP-1 drugs, which were first approved for treating type II diabetes, are currently gaining popularity as obesity treatment. Some analysts believed that total addressable markets for CGM devices is cut meaningfully with the rising adoption of these drugs. The potential rise in competition from GLP-1 drugs is an overhang for CGM-makers like DexCom, with analysts assuming negative impact over the next six months to a year.

However, DexCom stated in its presentation last week that it has surveyed and observed rising adoption of its CGM devices among patients initiating GLP-1 therapy, contradicting the assumptions. This caused DXCM’s shares to rise in the previous week.

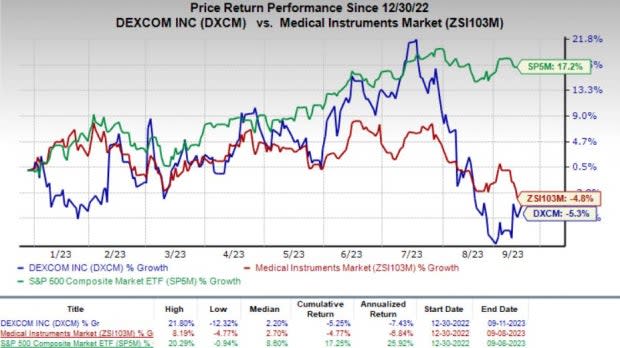

Price Performance

Shares of DexCom have lost 5.3% year to date compared with the industry’s 4.8% decline. The S&P 500 Index has gained 17.2% in the same time frame.

Image Source: Zacks Investment Research

DexCom Findings

While GLP-1 are drugs that are prescribed with specific doses within regular intervals, CGM devices are worn on the body and can measure blood sugar in real time. These devices are often paired with insulin pumps.

DexCom presented that the use of CGMs have increased across all segments of patients with type II diabetes after beginning treatment with GLP-1 drugs. Per the data provided, use of these monitoring devices doubled on average for patients on intensive insulin while the same was up 3.8 times for patients on basal insulin alone. The use of CGMs also increased in patients on non-insulin therapy by 4.2 times.

The company believes that the use of CGMs help patients to achieve dose titration for therapeutic regimen, as recommended in GLP-1 labeling. The simplicity of CGM systems is supporting its accelerated adoption, even for patients on GLP-1 therapy. Moreover, the use of these devices help increase the durability of health outcomes.

The presented facts imply that adoption of CGM devices is likely to continue going forward. With rising adoption of DexCom devices by GLP-1 users, the potential impact of GLP-1 competition is likely to diminish. However, investors should keep a watch on sales figure for these devices to get a clear picture of the competition landscape.

Industry Prospects

Per a report by Grand View Research, the CGM devices market was valued at $7.82 billion in 2022 and is anticipated to witness a CAGR of 4.4% from 2023 to 2030. Factors like the growing cases of diabetes, coupled with the increasing adoption CGM devices, are expected to drive the market.

Given the market potential and increased adoption among GLP-1 users, DexCom’s CGM business is likely to perform well in the future.

Notable Developments

Earlier this month, DexCom announced that its DexCom G6 CGM system will now connect with the Omnipod 5 Automated Insulin Delivery (AID) system in Germany. The company had added Omnipod AID to its CGM ecosystem in the U.K. in June.

In July, DexCom announced that its next-generation DexCom G7 CGM system received Health Canada’s approval for people with all types of diabetes, aged two years and above. Although approved by Health Canada, DexCom G7 is not yet available for purchase. DexCom Canada is working to make DexCom G7 available to diabetic Canadians by the end of 2023.

The same month, DexCom announced better-than-expected second-quarter results. Impressive contributions from the Sensor segment, and domestic and international revenue growth were the key catalysts. Moreover, expansion of coverage for CGM systems during the quarter supported growth that is likely to continue for the rest of 2023. The availability of new sensors like G6 and G7 in new international markets is also boosting revenue growth.

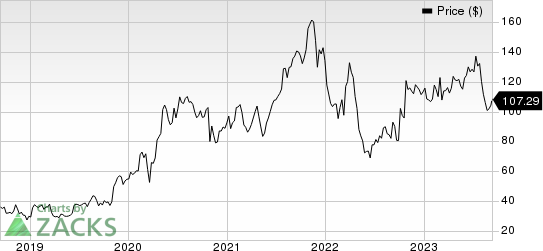

DexCom, Inc. Price

DexCom, Inc. price | DexCom, Inc. Quote

Zacks Rank & Stocks to Consider

DexCom currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Align Technology ALGN, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Align Technology, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 17.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ALGN’s earnings surpassed estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 1.76%. The company’s shares have risen 58.9% year to date compared with the industry’s 12% growth.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.1%.

The company’s shares have rallied 13.6% year to date against the industry’s 10.6% decline.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 8.1%.

The stock has rallied 13% year to date compared with the industry’s 12% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report