25 College Towns That Are Perfect for Retirees

Although retirees are decades from their college graduation, many are opting to live in college towns. According to MarketWatch, older Americans have been flocking to college towns for several reasons, including affordability, walkability and cultural, educational and entertainment opportunities.

In addition, college towns often have diverse populations, and with students and university staff moving in and out, there are always new people to meet. There’s also often a plethora of part-time job opportunities for retirees who may want some extra income to pad their savings.

Check Out: These Are America’s 50 Fastest-Growing Retirement Hot Spots

Read Next: 6 SUVs That Last Longer Than You Think and Are Worth the Money

Many college towns are beautiful as well. Offering great weather, and scenic routes that brought the University there in the first place.

To find the best college towns for retirees, GOBankingRates examined several factors, including livability scores, the percentage of the population ages 65 and older, monthly living costs (groceries, healthcare, utilities, transportation and other miscellaneous expenses) and housing costs.

Based on this analysis, these are the 25 best college towns for retirees.

1. Huntington, West Virginia

Livability score: 81

Percentage of the population ages 65 and older: 17.2%

Monthly expenditure costs: $1,951

Average mortgage: $707

Find Out: America’s 50 Most Expensive Retirement Towns

Discover More: 25 Places To Buy a Home If You Want It To Gain Value

2. Lexington, Kentucky

Livability score: 86

Percentage of the population ages 65 and older: 13.5%

Monthly expenditure costs: $1,775

Average mortgage: $1,783

Read Next: If You Have $1 Million in Retirement Savings, Here’s How Much You Could Withdraw Per Year

3. Stevens Point, Wisconsin

Livability score: 85

Percentage of the population ages 65 and older: 12.7%

Monthly expenditure costs: $1,691

Average mortgage: $1,491

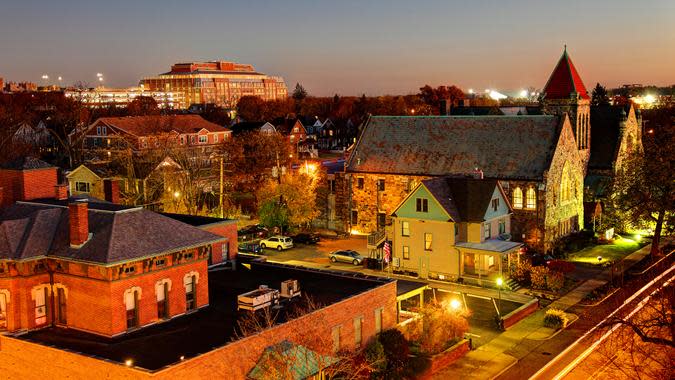

Pictured: University of Wisconsin Madison

4. Ames, Iowa

Livability score: 90

Percentage of the population ages 65 and older: 10.5%

Monthly expenditure costs: $1,863

Average mortgage: $1,886

5. Lawrence, Kansas

Livability score: 88

Percentage of the population ages 65 and older: 11.6%

Monthly expenditure costs: $1,882

Average mortgage: $1,829

6. Normal, Illinois

Livability score: 87

Percentage of the population ages 65 and older: 11%

Monthly expenditure costs: $1,816

Average mortgage: $1,424

Explore More: I’m a Retired Boomer: 7 Reasons I Wish I Used a Financial Advisor To Plan For Retirement

7. Winona, Minnesota

Livability score: 77

Percentage of the population ages 65 and older: 16.9%

Monthly expenditure costs: $1,618

Average mortgage: $1,357

8. Lewisburg, Pennsylvania

Livability score: 79

Percentage of the population ages 65 and older: 17%

Monthly expenditure costs: $1,926

Average mortgage: $1,796

9. Norman, Oklahoma

Livability score: 84

Percentage of the population ages 65 and older: 12.7%

Monthly expenditure costs: $1,876

Average mortgage: $1,521

10. Greensboro, North Carolina

Livability score: 82

Percentage of the population ages 65 and older: 13.3%

Monthly expenditure costs: $1,702

Average mortgage: $1,571

Check Out: I’m an Economist: Here’s My Prediction for Social Security If Kamala Harris Wins the Election

11. Evanston, Illinois

Livability score: 83

Percentage of the population ages 65 and older: 16.4%

Monthly expenditure costs: $1,931

Average mortgage: $3,319

12. Richardson, Texas

Livability score: 85

Percentage of the population ages 65 and older: 13.5%

Monthly expenditure costs: $1,927

Average mortgage: $2,767

13. Denton, Texas

Livability score: 86

Percentage of the population ages 65 and older: 11.2%

Monthly expenditure costs: $1,826

Average mortgage: $2,210

14. Ann Arbor, Michigan

Livability score: 88

Percentage of the population ages 65 and older: 12%

Monthly expenditure costs: $1,784

Average mortgage: $3,200

Find Out: I’m a Retired Boomer: Here Are 3 Debts You Should Definitely Pay Off Before Retirement

15. Greenville, South Carolina

Livability score: 79

Percentage of the population ages 65 and older: 14.4%

Monthly expenditure costs: $1,740

Average mortgage: $1,789

16. Champaign, Illinois

Livability score: 83

Percentage of the population ages 65 and older: 10.6%

Monthly expenditure costs: $1,808

Average mortgage: $1,245

17. Iowa City, Iowa

Livability score: 84

Percentage of the population ages 65 and older: 11%

Monthly expenditure costs: $1,758

Average mortgage: $1,935

18. Chattanooga, Tennessee

Livability score: 75

Percentage of the population ages 65 and older: 16.8%

Monthly expenditure costs: $1,766

Average mortgage: $1,791

Trending Now: Here Are All the Promises Trump Has Made About Social Security If He’s Reelected

19. Syracuse, New York

Livability score: 79

Percentage of the population ages 65 and older: 12.6%

Monthly expenditure costs: $1,966

Average mortgage: $1,069

20. West Lafayette, Indiana

Livability score: 90

Percentage of the population ages 65 and older: 6.7%

Monthly expenditure costs: $1,699

Average mortgage: $2,055

21. Newark, Delaware

Livability score: 83

Percentage of the population ages 65 and older: 12.1%

Monthly expenditure costs: $2,000

Average mortgage: $2,071

22. Eugene, Oregon

Livability score: 78

Percentage of the population ages 65 and older: 16.5%

Monthly expenditure costs: $1,755

Average mortgage: $2,907

Explore More: Trump Wants To Eliminate Income Taxes: How Would That Impact You If You Are Retired?

23. Buffalo, New York

Livability score: 78

Percentage of the population ages 65 and older: 12.9%

Monthly expenditure costs: $1,957

Average mortgage: $1,333

24. Tallahassee, Florida

Livability score: 82

Percentage of the population ages 65 and older: 10.8%

Monthly expenditure costs: $1,863

Average mortgage: $1,782

25. Lubbock, Texas

Livability score: 78

Percentage of the population ages 65 and older: 12%

Monthly expenditure costs: $1,809

Average mortgage: $1,268

Methodology: To find college towns that are perfect for retirees, GOBankingRates analyzed numerous college towns in the United States sourced from ListWithClever’s Best College Towns. With a list of college towns, GOBankingRates found the [1] total population and [2] population ages 65 and over sourced from the U.S. Census American Consumer Survey. Using those factors, the percentage of the population aged 65 and over was calculated. For each city on the list, the cost of living was calculated based on [3] grocery cost-of-living index, [4] healthcare cost-of-living index, [5] utilities cost-of-living index, [6] transportation cost-of-living index and [7] miscellaneous cost-of-living index, all sourced from Sperlings BestPlaces. The cost-of-living indexes were multiplied by the national average expenditure costs for people ages 65 and over, sourced from the Bureau of Labor Statistics Consumer Expenditure Survey, to find the cost of living across all the expenditure categories for each city. The livability index was sourced from AreaVibes, scored and weighted at 1.25. Using the Zillow Home Value Index, the average home value in August 2023 was sourced, and using the Federal Reserve Economic Research’s national average 30-year fixed-rate mortgage, the average mortgage cost was calculated. The average mortgage combined with the monthly expenditure cost gives the total monthly cost for each city. The percentage of the population ages 65 and over was scored and weighted at 1.00, the total monthly cost was scored and weighted at 1.50, and the livablity index was scored and weighted at 1.25. All the scores were combined and sorted to show the college towns that are perfect for retirees. All data is up to date as of April 2, 2024.

More From GOBankingRates

Here's the Minimum Salary Required To Be Considered Upper-Middle Class in 2025

How Much Would I Save if I Cut My Credit Card Interest to Low APR for a Year?

This article originally appeared on GOBankingRates.com: 25 College Towns That Are Perfect for Retirees