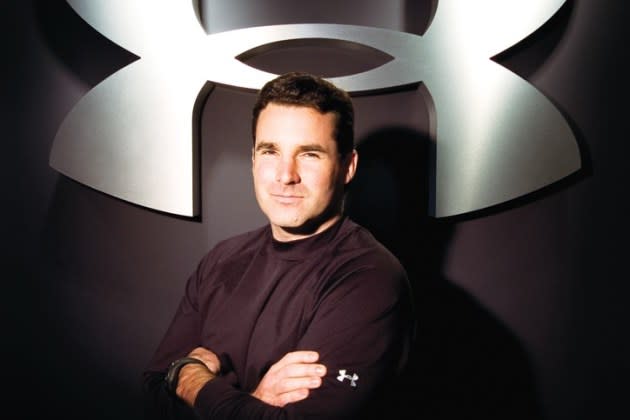

Under Armour Shares Dive 10 Percent Over CEO Turmoil as Kevin Plank Returns to Role

Wall Street gave a firm thumbs down to the return of Kevin Plank to the top spot at Under Armour, punishing the company by sending its shares down by 10.2 percent to $6.99 in trading on Thursday.

While some analysts are hopeful that Plank is the fuel needed to return the company to its glory days, the fact that Under Armour has had three chief executive officers in four years was the reason for the stock’s steep decline on Thursday, the day after the Baltimore-based sports brand said Plank would succeed Stephanie Linnartz as president and chief executive officer.

More from WWD

The surprise announcement of Linnartz’s departure, and Plank’s return, was revealed by the company Wednesday after the close of the stock market.

Linnartz, the former president of Marriott International, assumed the role of CEO of Under Armour in February 2023 and had been building her team to implement Protect This House 3, a three-year turnaround plan designed to raise awareness of the Under Armour brand, deliver elevated designs and products to boost U.S. sales and maintain the company’s momentum overseas.

But her plan did not have immediate positive impact and speculation was rampant that the board was running out of patience and not willing to wait. The biggest issue is the company’s performance in North America, its largest market, which accounts for around two-thirds of its overall sales. In the third quarter results released in February, Under Armour reported stronger than expected net income of $114.1 million, but sales in North America were down 12 percent. International revenue was up 7 percent with strength in Europe, the Middle East, Africa, Asia Pacific and Latin America.

In addition, Under Armour’s continued attempts to gain a true foothold in the performance footwear market has also been discouraging with sales in that category down 7 percent in the quarter.

Craig Johnson, president of Customer Growth Partners, said Under Armour’s struggles in North America mean the company is losing market share, which is “not a good position.” Right now, he estimated that Under Armour has a 4.5 percent share of the U.S. market, down from 5.5 percent last year while upstarts On and Hoka continue to make inroads and Lululemon gains more fans. The two biggest players, Nike and Adidas, are essentially “treading water,” he said.

In addition, Johnson said that because Plank was still so entrenched in the company as executive chairman of the board and brand chief for the past four years, it must have been very difficult for Linnartz to chart a new path.

“It’s a tough position when the founder is still hanging around, especially someone like Kevin who embodies the core DNA of the company, which is performance.”

Despite the turmoil, Johnson is optimistic that the return of Plank to the CEO role may be just what the company needs. “I think he can do it, he’s a dynamic guy and he’s coming at it from a more mature, thoughtful perspective,” he said. “They still have a great brand, even if they’ve lost a half step on newness. The question is whether Kevin can duplicate Steve Jobs’ return to Apple.”

Plank founded Under Armour in 1996 in his grandmother’s basement and served as its CEO and chairman of the board until January 2020, when he was appointed executive chair and brand chief. At the time, the company was faltering both in terms of sales as well as with scandals ranging from strip-club visits by senior executives to Securities and Exchange Commission investigations. He was succeeded by Patrik Frisk, a one-time CEO of the Aldo Group, in 2020. But Frisk’s tenure was also short, lasting just only two years.

Although Plank declined requests for an interview Thursday, he did share some insights with employees following the news. He credited Linnartz for helping “advance the company forward in many important ways, including elevating our leadership talent in product, design, supply chain, consumer loyalty and regional management. She also played a key role in focusing on our current strategy and challenging the balance between our strengths and opportunities. Much work still needs to be done, but her leadership helped put us on the right track toward winning.”

The letter then became more personal. Plank wrote: “Reflecting on my journey at UA, I realize that the principles of Be Humble/Stay Hungry resonate more strongly today than ever. During my time away from the president and CEO role, which spanned more than four years, I have learned many lessons — professionally and personally. This period of self-reflection and learning has been invaluable, shaping my understanding of our business and reinforcing our mission, vision and values. The experience of not being a CEO has taught me more about what it truly means to be a CEO. I am deeply humbled to have been entrusted by our board to lead Under Armour at this pivotal time for the company.”

But his key team has been dismantled, which could present complications for Plank.

Since her appointment, Linnartz replaced many of the company’s longtime employees and brought in a whole new team, including Yassine Saidi as chief product officer, Kara Trent president of the Americas, Jim Dausch as chief customer officer, Shawn Curran as chief supply chain officer, John Varvatos as head of design and Amanda Miller as chief communications officer. The company is still searching for a chief marketing officer and senior vice president for footwear.

This team that Plank is inheriting may shift again, sources speculate, as he sets out to rebuild the business with his own handpicked group.

In his employee letter, Plank added that his vision for the future of Under Armour is “not about revisiting any previous chapter” in the company’s history, but “instead, we will leverage the wisdom of our past experiences, applying this knowledge to ensure we make the best decisions in the chapter ahead — and make it our finest.”

Analysts were quick to weigh in with their thoughts about the abrupt change. Simeon Siegel of BMO Capital Markets, believes it was a “board-level decision” driven by a desire for further change — the directors were not satisfied with Linnartz’s dramatic C-suite changes and introduction of a rewards program, he wrote. Now it’s up to Plank to rediscover the magic that had marked the company’s explosive early growth.

“We expect Mr. Plank is excited to reenter the role (this doesn’t appear a temporary/interim move), but we recognize that with further C-suite fluctuation, the burden of proof lies on management execution and results that show this is not repeating the recent past.”

Tom Nikic of Wedbush said the “musical chairs” of CEOs over the past few years “brings a level of inconsistency and uncertainty to the story that investors don’t really want to see.” Jim Duffy of Stifel agreed, saying the “revolving door of CEOs will likely weigh on the stock.”

Neil Saunders, managing director of GlobalData, was even more harsh. He said the dramatic change in leadership “is emblematic of a brand that can’t quite decide which direction it wants to go in. Under Armour has already been through several rounds of change as it tries to address declining sales and issues with the brand but, as the latest set of poor quarterly results show, it has not yet found a successful path to rebuilding the business.”

He added that the departure of Linnartz, “who has just set out her vision for the company, likely means more shifts. The good news is that Kevin Plank is more than familiar with the company so should be able to quickly plot the route that he wants to take to get the brand back on track.”

But all these “twists and turns have created a brand that has become increasingly confusing to consumers and to wholesale partners,” he believes, and “remedying these problems are not simple, no matter who occupies the CEO seat.”

Linnartz also provided some further context on her impending departure on her LinkedIn page. She will remain as an adviser to Under Armour until April 30. She said she was “extremely proud of the progress our team has made. We have a strong foundation in place for future growth, including strengthening our team, evolving our products and marketing and increasing our focus on profitability.”

According to Siegel, parting ways with Linnartz will result in separation costs of a one-time cash payment of $2.6 million, twice her current salary, her fiscal year 2024 performance bonus, full vesting of her sign-on stock awards, valued at around $7.3 million, payment of her medical premiums for 24 months and the assumption of the lease on her Baltimore apartment until the middle of the year.

Best of WWD