Ultragenyx Pharmaceutical (NASDAQ:RARE) shareholders have endured a 51% loss from investing in the stock a year ago

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that Ultragenyx Pharmaceutical Inc. (NASDAQ:RARE) stock has had a really bad year. The share price is down a hefty 51% in that time. However, the longer term returns haven't been so bad, with the stock down 13% in the last three years. Furthermore, it's down 20% in about a quarter. That's not much fun for holders.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Ultragenyx Pharmaceutical

Given that Ultragenyx Pharmaceutical didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Ultragenyx Pharmaceutical's revenue didn't grow at all in the last year. In fact, it fell 0.6%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 51%. Having said that, if growth is coming in the future, the stock may have better days ahead. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

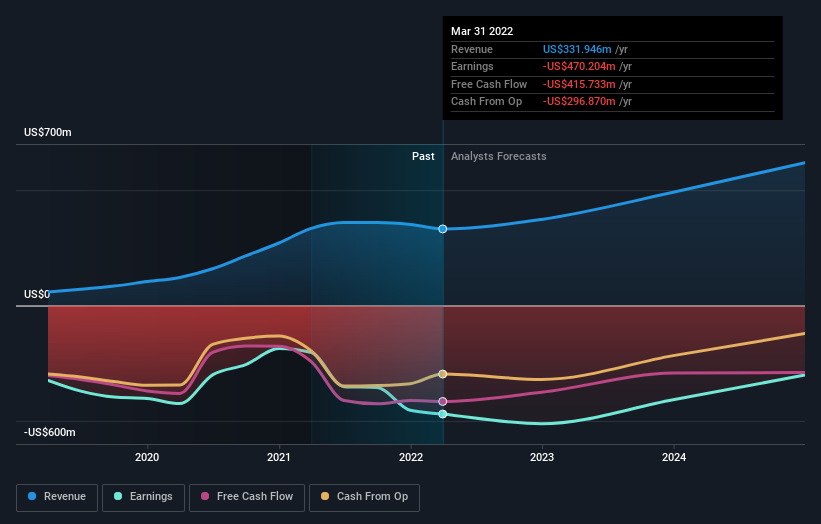

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Ultragenyx Pharmaceutical is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

While the broader market lost about 16% in the twelve months, Ultragenyx Pharmaceutical shareholders did even worse, losing 51%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Ultragenyx Pharmaceutical better, we need to consider many other factors. Take risks, for example - Ultragenyx Pharmaceutical has 3 warning signs we think you should be aware of.

We will like Ultragenyx Pharmaceutical better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.