Pinning Down MediWound Ltd.'s (NASDAQ:MDWD) P/S Is Difficult Right Now

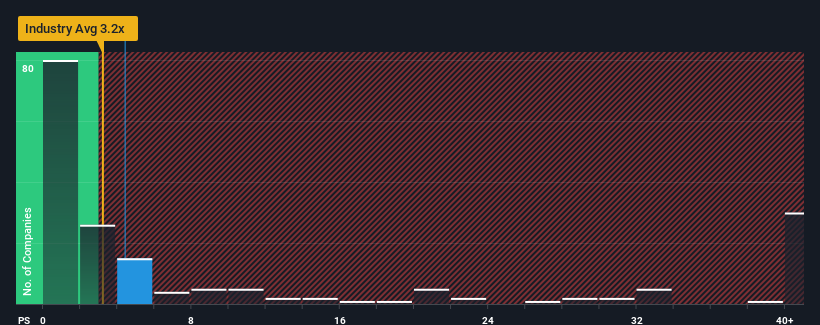

You may think that with a price-to-sales (or "P/S") ratio of 4.4x MediWound Ltd. (NASDAQ:MDWD) is a stock to potentially avoid, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios under 3.2x and even P/S lower than 0.9x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for MediWound

What Does MediWound's Recent Performance Look Like?

Recent times haven't been great for MediWound as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on MediWound will help you uncover what's on the horizon.

Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, MediWound would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 17% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 18% per year during the coming three years according to the four analysts following the company. With the industry predicted to deliver 31% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that MediWound is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does MediWound's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see MediWound trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for MediWound (1 shouldn't be ignored!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here