Monopolies Dominating Thai Stocks at Risk After Election Shock

(Bloomberg) -- The playbook for investing in Thai stocks is on the cusp of getting rewritten after reform-minded parties swept last month’s election to end a near decade-long rule by a military-backed royalist establishment.

Most Read from Bloomberg

Amazon Is in Talks to Offer Free Mobile Service to US Prime Members

Rich Latin Americans Transform Laid-Back Madrid Into a New Miami

Hedge Funds at War for Top Traders Dangle $120 Million Payouts

US Chides China Over Defense Talks as Navy Sails Taiwan Strait

A coalition led by surprise winner Move Forward is promising to tackle monopolies and reduce power costs if it successfully forms government. The agenda may come at the expense of Thailand’s richest men, who control companies that make up almost a fifth of the benchmark SET index’s weighting.

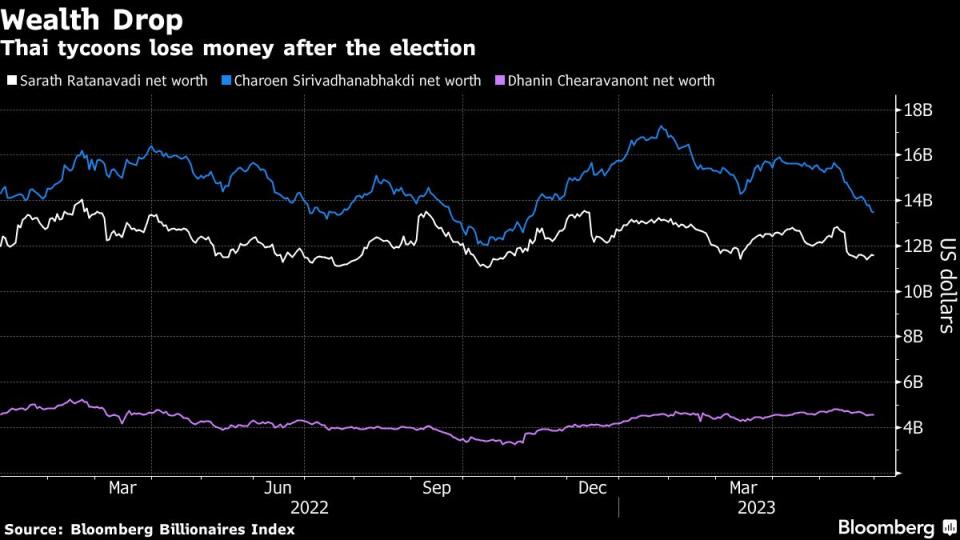

Since the May 14 polls, investors have started cashing out of firms linked to Sarath Ratanavadi, Dhanin Chearavanont and Charoen Sirivadhanabhakdi. Some of the nation’s biggest industries, from power to telecoms and liquor makers, will be under scrutiny as Move Forward pledges to promote more competition. Analysts also expect concessions granted under the previous government to be re-examined.

“Regulatory risk will hang over large dominant business groups for some time as a new government is determined to quickly push through the anti-monopoly policy,” said Prapas Tonpibulsak, chief investment officer at Talis Asset Management Co. in Bangkok. “This will damp sentiment in the stock market as those companies have very significant weightings.”

The SET Index has declined almost 9% this year, and is the worst country gauge in Asia with the policy uncertainty. Foreigners have sold $929 million worth of equities since the election, according to data compiled by Bloomberg.

Power Reforms

Companies controlled by Sarath, the nation’s second-richest man, have borne the brunt of the selloff. His flagship Gulf Energy Development Pcl, the No. 1 private power producer, was among the biggest drags on the key stock index since the poll.

Telecom firms Intouch Holdings Pcl and Advanced Info Service Pcl have also underperformed, contributing to the $4.2 billion erased from the market value of Sarath’s companies since the poll.

During its campaign, Move Forward pledged to liberalize the power industry by allowing the public to buy electricity directly from producers. It also plans to renegotiate concessions.

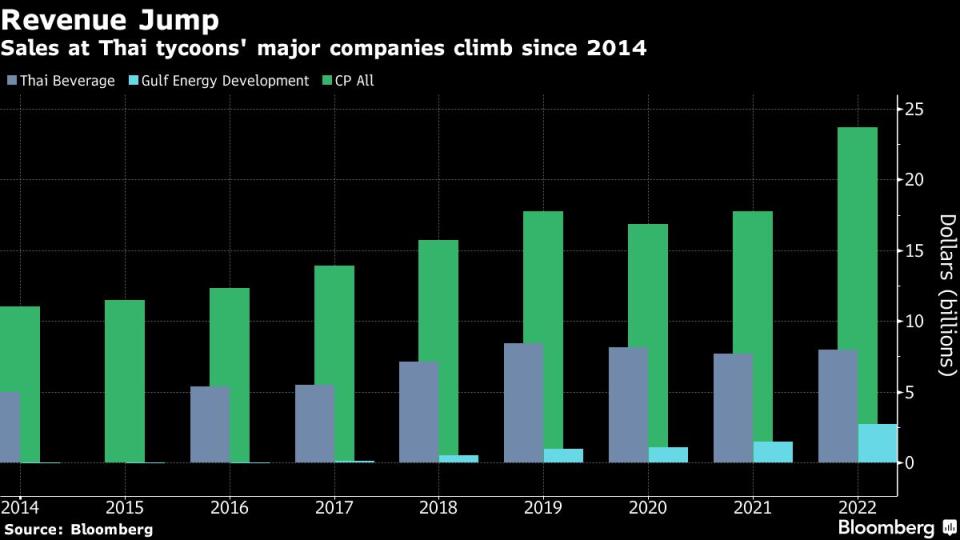

Gulf Energy, which doubled its revenue last year, gets most of its income from long-term contracts with the Electricity Generating Authority of Thailand. It has, with partners, added a deep-sea port and tollway concessions worth a total of about 80 billion baht ($2.3 billion) as well as power plant contracts from Prime Minister Prayuth Chan-Ocha’s outgoing government.

Under Prayuth’s administration, the SET Index has advanced 11%. Stocks including Gulf, Advanced Info, Dhanin’s CP ALL Pcl, and the Chirathivat family’s Central Pattana Pcl, were among the biggest contributors to the gains.

Thai Beverage Pcl, Gulf Energy and Charoen Pokphand Group didn’t respond to queries seeking comments.

Craft Beer

“The Thai economy has been dominated by a handful of large business groups for so long,” said Thitinan Pongsudhirak, a lecturer of political science at Chulalongkorn University. “Reducing their monopoly power will definitely benefit the overall economy in the long run by offering opportunities to small entrepreneurs and businesses.”

“For example, if you liberalize the liquor industry, you would get a lot of good craft beers from local producers coming into the market,” Thitinan said.

Charoen’s Thai Beverage, the nation’s largest whiskey maker, may see its business come under pressure. The Singapore-listed stock has fallen 18% this year, compared with the benchmark index’s 2.6% decline.

One company controlled by Dhanin has already come under the spotlight.

The billionaire’s True Corp. Pcl’s merger with Telenor ASA’s Total Access Communication Pcl last year to create the country’s largest mobile firm was criticized by Move Forward. The political party threatened then to sue the National Broadcasting and Telecommunication Commission for its alleged negligence in agreeing to a deal that left the country with just two private mobile phone firms.

Concessions-based companies are expected to come under more pressure, according to Narongdach Juntarapaisarn, an analyst at Aira Securities Co. in Bangkok. The “policy impact on those in retail and telecom sectors would be limited,” he said.

Still, it remains to be seen if Move Forward’s leader Pita Limjaroenrat can pull together enough support to become Thailand’s next prime minister. The coalition doesn’t have enough seats to by-pass a military-appointed Senate in the selection of the next leader.

“Move Forward’s policies are radical,” said Thitinan. “That worries investors. Its policies will be a complete transformation of the Thai economy.”

Most Read from Bloomberg Businessweek

Harvard MBA Grads Enter a Tepid Job Market Hoping for the Best

Can Workplace Ketamine Retreats Improve Vibes in the Office?

Goldman CEO Loves Summer Camp So Much He’s Expanded His Portfolio

Assault Allegations Plague a $1.4 Billion Home Eldercare Startup

©2023 Bloomberg L.P.