3 Things to Consider Before You Buy Your Next Watch, According to a Veteran Dealer

It’s been an interesting few years in the watch industry to say the least. Looking at 2023 alone, Swiss watch exports hit a record $31 billion and Rolex sales hit $10 billion for the first time. While prices fell by about 13 percent across the board in the secondary market, pre-owned watches continue to be a more than $22 billion dollar business with powerhouse brands like Rolex rolling out their own certified pre-owned programs—plus, studies still estimate pre-owned models will outsell new models in the next decade. In addition, the collecting community remains strong, particularly in the U.S., which has become the most important single-country market for Swiss watches with exports reaching approximately $3 billion last year.

Now, we’re on the precipice of Watches & Wonders, arguably the largest trade show in the industry, and soon auction season will be right around the corner. Before the market becomes inundated with new releases and sales, what better time to have a firm grasp on the best investments you can make for your collection? We sat down with Matthew Bain, an industry veteran who’s been dealing watches and consulting major auction houses like Sothebys and Christies since 1989, to get his take on the pulse of the market in 2024.

More from Robb Report

Bulgari's Latest Octo Finissimo Watches Have Sketches of Movements Right on the Dial

A Rare 15-Carat Yellow Diamond Ring Could Fetch $1.2 Million at Auction This Spring

Louis Vuitton Enlists Frank Gehry and Its Mascot for Its Creative New Watches

Who to Watch

If there’s any sign of the strength of the collecting community in the current market, it’s the categories that are performing well: independents, complications, and women’s designs. Each of these areas reflect a true appreciation for the art of watchmaking outside of passing trends.

“Independent watchmakers are really strong in the market right now,” confirms Bain. “You used to see a watch from George Daniels maybe once every ten years, and last year, three or four of them came to auction. Then there are other more contemporary independents like Roger Smith and Philippe Dufour—to see watches that were made in the last decade rake in almost a million dollars is pretty phenomenal.”

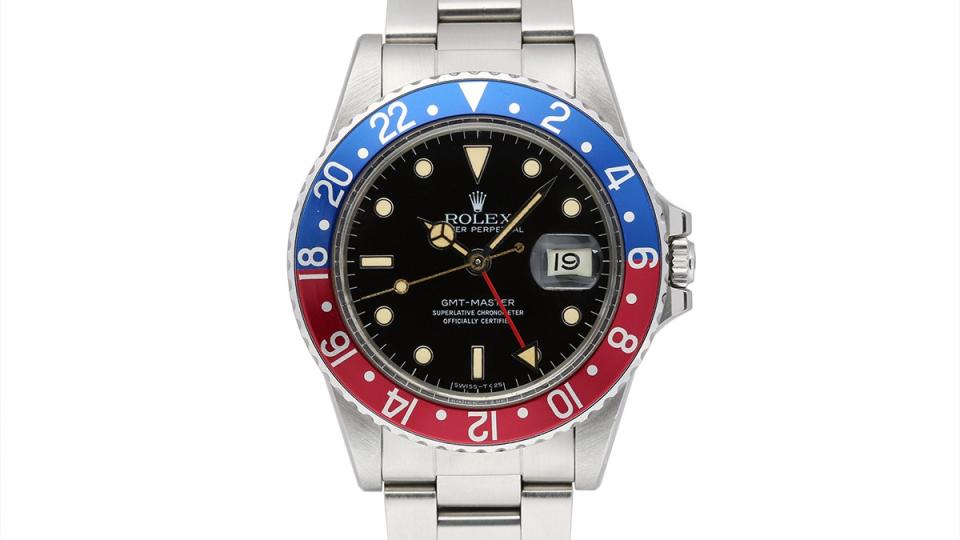

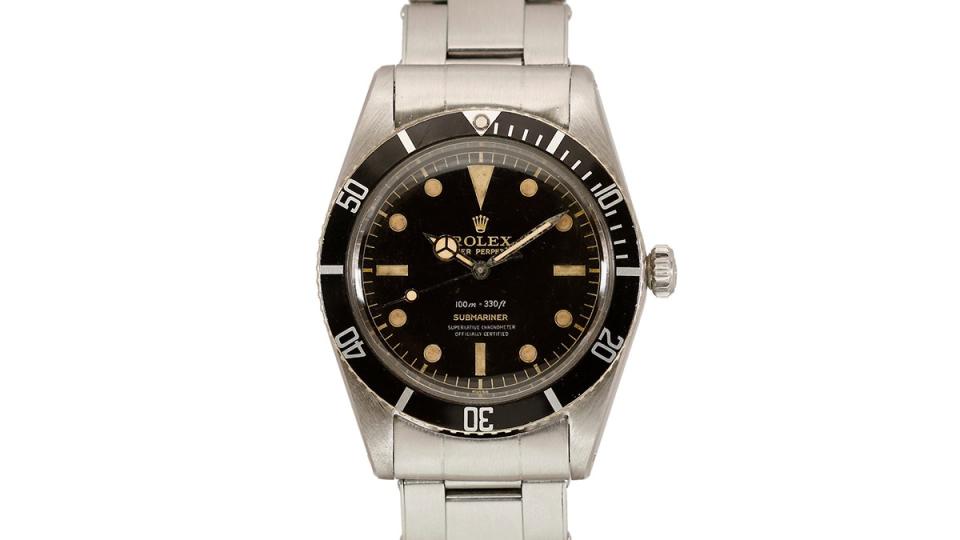

The rise of independents isn’t just reflective of a renewed interest in thoughtful design and technical innovation. It’s emblematic of a shift in the industry as a whole, which is becoming increasingly inclusive of newcomers and fresh perspectives. Yet, for an industry deeply rooted in tradition, the past will always remain important—even the more recent past. The Neo Vintage category has started gaining more and more traction in the past couple years. It, unsurprisingly, started with Rolex and an increased demand for models such as Submariners and GMTs from the 1980s. Now, according to Bain, a new facet of Neo Vintage is picking up momentum.

“There’s another Neo Vintage trend emerging in the past year,” asserts Bain, “and that’s complicated watches from good names—think Breguet with a perpetual calendar or Blancpain with a moonphase from the ’80s and ’90s. There’s not many of them out there, but right now, they’re trading at reasonable prices. You can still find them for under $100,000, which is a great price point—a great investment.”

Perhaps the most underestimated sectors of the watch industry have been women’s watches and the female collector base, but the tides are turning. Bain feels that female collectors are a force to be reckoned with and that women’s watches in the secondary market are largely representative of design done right in terms of sweet spot sizing and timelessness.

“I’ve always loved women’s watches,” Bain confesses. “I think the ideal watch size is from 36mm to 38mm, and 10 years ago, when the trend was these big 41mm or 42mm watches, you had to look to women’s models to find more accessible proportions that are far more timeless, not the product of a fad. And women are smart collectors,” he continues, “sometimes more than men. They’re not as speculative. They know what they like and have strong opinions, so they’re less swayed by trends, and they tend to hold their watches longer and ride out shifts in the market.”

Condition is King

When buying vintage or pre-owned, there are always a multitude of factors to weigh into your decision. However, from a long-term investment perspective, there’s one particular element worth considering: condition.

“Average quality, I think, is suffering across the board in the secondary market, so condition is becoming really important,” observes Bain. “Watches in fair condition are dipping in value a bit whereas mint condition watches are going to continue breaking world records.”

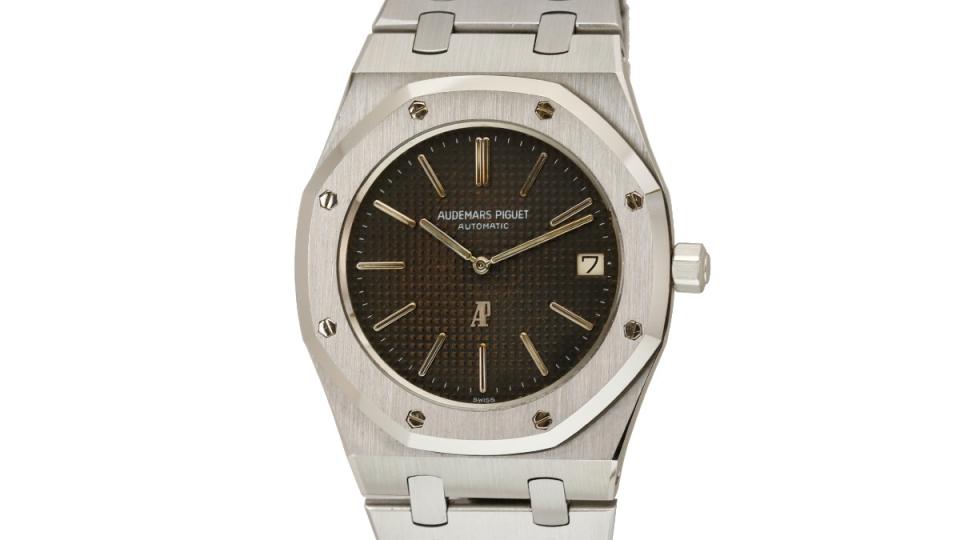

According to Bain, the condition of the watch really weighs into its value regardless of the brand—from industry powerhouses like AP or Patek to others like Breitling or TAG Heuer. That said, looking to the pricing of models from big brands is a good measure of what’s retaining value in the market.

“Take Rolex for example: Rolex sport models have cooled a bit unless they’re mint condition,” shares Bain. “If you find a mint condition, say 1950s GMT or a James Bond model or even a Neo Vintage sport reference from the 70s or 80s, the market is really strong.”

Trends in terms of style, size, and materials will come and go. To some extent, even the popularity of certain brands will fluctuate with the times. That said, investing based on condition is always a smart bet, even if you end up paying over market value.

“I wouldn’t be afraid to pay a premium on a watch that’s in an incredible condition nor should a collector be afraid to do that,” encourages Bain. “In the long run, it’s always worth the premium you pay for a mint condition watch, even if it’s a world record price.”

Trends to Embrace (and Avoid)

It’s hard, perhaps impossible, to talk about the state of the watch market in the past few years without acknowledging the brands and models that have skyrocketed to record levels of demand and price. On one hand, this feels like an overwhelming positive—a sign that the industry is flourishing. But it also begs the question, should we be skeptical when a particular brand or model seems to be performing too well? How should we adjust our buying habits (or not) to a shifting market? In closing, Bain gives us his advice on how to be a serious collector in the current climate.

“For example, Cartier has been on fire the past couple years—everyone is asking for Tanks—but you have to be careful of trends like this,” Bain cautions. “Look back the AP Royal Oak,” he continues. “For a long time, demand and, in turn, prices just rose and rose and rose. At one point, prices were close to $200,000 for an A series 5402—they went up too high, too fast—and now they’re worth what they should be. What goes up must come down!” Bain reminds us. “Cartier is great right now, but things will always ebb and flow. That said, if you want to buy a Cartier, you should do it because you really love Cartier, not because it’s on trend. My advice to young enthusiasts: if you really want to be a serious collector, don’t get caught up in the fads. Watch collecting is a long game.”

Best of Robb Report

Sign up for Robb Report's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.