Understanding The Economic Realities Behind Wind And Solar Energy

A major reason for the growth in the use of renewable energy is the fact that if a person looks at them narrowly enough–such as by using a model–wind and solar look to be useful. They don’t burn fossil fuels, so it appears that they might be helpful to the environment.

As I analyze the situation, I have reached the conclusion that energy modeling misses important points. I believe that profitability signals are much more important. In this post, I discuss some associated issues.

Overview of this Post

In Sections [1] through [4], I look at some issues that energy modelers in general, including economists, tend to miss when evaluating both fossil fuel energy and renewables, including wind and solar. The major issue in these sections is the connection between high energy prices and the need to increase government debt. To prevent the continued upward spiral of government debt, any replacement for fossil fuels must also be very inexpensive–perhaps as inexpensive as oil was prior to 1970. In fact, the real limit to fossil fuel extraction and to the building of new wind turbines and solar panels may be government debt that becomes unmanageable in an inflationary period.

In Section [5], I try to explain one reason why published Energy Return on Energy Investment (EROEI) indications give an overly favorable impression of the value of adding a huge amount of renewable energy to the electric grid. The basic issue is that the calculations were not set up for this purpose. These models were set up to evaluate the efficiency of generating a small amount of wind or solar energy, without consideration of broader issues. If these broader issues were included, EROEI indications would be much lower (less favorable).

One of the broader issues omitted is the fact that the electrical output of wind turbines and solar panels does not match up well with the timing needs of society, leading to the need for a great deal of energy storage. Another omitted issue is the huge quantity of energy products and other materials required to make a transition to a mostly electrical economy. It is easy to see that both omitted issues would add a huge amount of energy costs and other costs, if a major transition is made. Furthermore, wind and solar have gotten along so far using hidden subsidies from the fossil fuel energy system, including the subsidy of being allowed to go first on the electricity grid. EROEI calculations cannot evaluate the amount of this hidden subsidy.

In Section [6], I point out the true indicator of the feasibility of renewables. If electricity generation using wind and solar energy are truly helpful to the economy, they will generate a great deal of taxable income. They will not require the subsidy of going first, or any other subsidy. This does not describe today’s wind or solar.

In Section [7] and [8], I explain some of the reasons why EROEI calculations for wind and solar tend to be misleadingly favorable, even apart from broader issues.

Economic Issues that Energy Modelers Tend to Miss

[1] The economy is very short of oil that is inexpensive-to-extract. The economy seems to require a great deal more government debt when energy prices are high. Models for renewable energy production need to consider this issue, even if any substitution for oil is very indirect.

I think of the problem of rising energy prices for an economy as being like a citizen faced with an increase in food costs. The citizen will attempt to balance his budget by adding more debt, at least until his credit cards get maxed out. This is why we should expect to see an increase in government debt when oil prices are high; oil and other fossil fuels are as essential to the economy as food is to humans.

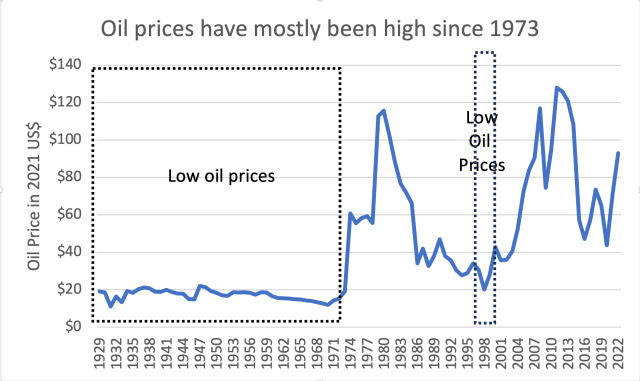

Figure 1. Year by year comparison of US government receipts with US government expenditures, based on data of the US Bureau of Economic Analysis, together with boxes showing when oil prices were in the range of about $20 per barrel or less, after adjusting for inflation. Series shown is from 1929 to 2022.

Figure 1 shows that most US government funding shortfalls occurred when oil prices were above $20 per barrel, in inflation-adjusted prices. For the 15-year period 2008 through 2022, US government expenditures were 26% higher than its receipts.

Figure 2 shows a reference chart of average annual oil prices, adjusted for inflation.

Figure 2. Average annual inflation-adjusted Brent oil prices based on data from BP’s 2022 Statistical Review of World Energy.

The reason why oil prices tend to be high now is because the inexpensive-to-extract oil has mostly been extracted. What is left is oil that is expensive to extract. The low prices in the years surrounding 1998 reflected a supply-demand mismatch after the Asian Economic Crisis of 1997. The crisis held down demand at the same time as production was ramping up in Iraq, Venezuela, Canada, and Mexico.

[2] Economists tend to assume that shortages of oil will lead to much higher fossil fuel prices, thereby making renewables inexpensive in comparison. One reason this doesn’t happen is related to the buildup of debt, noted in Figure 1, when oil prices are high.

Section [1] shows that high oil prices seem to be associated with government deficits. A high-priced substitute for oil would almost certainly have a similar problem. This governmental debt tends to build up, and at some point becomes almost unmanageable.

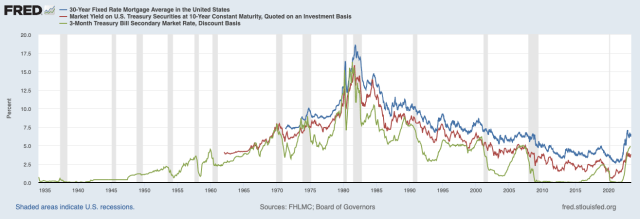

A major problem occurs when there is a round of inflation. Central banks find a need to increase interest rates, partly to keep lenders interested in lending in an inflationary economy and partly to try to slow the inflation rate. In fact, the US is currently being tested by such a debt buildup and increase in interest rates, beginning about January 2022 (Figure 3).

Figure 3. Chart by the Federal Reserve of St. Louis showing US 30-year mortgage rates, interest rates of 10-year Treasuries, and interest rates of 3-month Treasury Bills from 1935 through May 2023.

Higher interest rates tend to have the effect of slowing the economy. In part, the economy slows because the cost of borrowing money rises. As a result, businesses are less likely to expand, and would-be auto owners are likely to put off new purchases because of the higher monthly payments. Commercial real estate can also be adversely affected by rising interest rates if owners of buildings find it impossible to raise rents fast enough to keep up with higher interest rates on mortgages and higher costs of other kinds.

[3] It is uncertain in exactly which ways the economy might contract, in response to higher interest rates. Some ways the economy could contract would bring an early end to both the extraction of fossil fuels and the manufacturing of renewables. This is not reflected in models.

If the economy contracts, one possible result is a recession with lower oil prices. This clearly doesn’t fix the problem of the cost of wind and solar electricity being unacceptably high, especially when the cost of all the batteries and additional transmission lines is included. In some sense, the price needs to be equivalent to a $20 per barrel oil price, or lower, to stop the huge upward debt spiral.

Another possibility, rather than the US economy as a whole contracting, is that the US government will disproportionately contract; perhaps it will send many programs back to the states. In such a scenario, there is likely to be less, rather than more, funding for renewables. I understand that Republicans in Texas are already unhappy with the high level of wind and solar generation being used there.

A third possibility is hyperinflation, as the government tries to add more money to keep the overall system, especially banks and pension plans, from failing. Even with hyperinflation, there is no particular benefit to renewables.

A fourth possibility is disruption of trade relationships between the US and other countries. This could even be related to a new world war. Renewables depend upon worldwide supply lines, just as today’s fossil fuels do. Building and maintaining the electrical grid also requires worldwide supply lines. As these supply lines break, all parts of the system will be difficult to maintain; replacement infrastructure after storms will become problematic. Renewables may not last any longer than fossil fuels.

[4] Economists tend to miss the fact that oil prices, and energy prices in general, need to be both high enough for the producer to make a profit and low enough for consumers to afford finished goods made with the energy products. This two-way tug-of-war tends to keep oil prices lower than most economists would expect, and indirectly caps the total amount of oil that can be extracted.

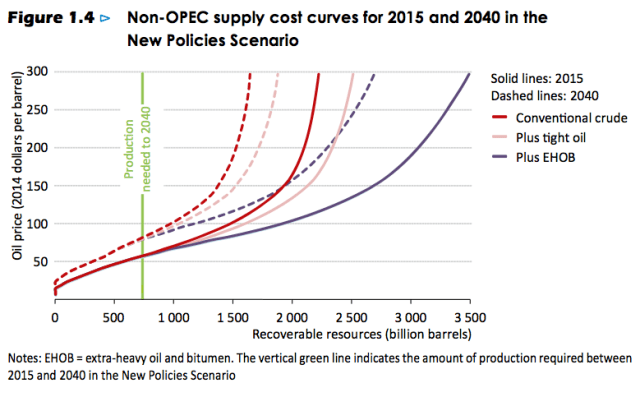

Figure [2] shows that, on an annual average basis, inflation-adjusted Brent oil prices have only exceeded $120 per barrel during the years 2011, 2012 and 2013. On an annual basis, oil prices have not exceeded that level since then. For a while, forecasts of oil prices as high as $300 per barrel in 2014 US dollars were being shown as an outside possibility (Figure 4).

Figure 4. IEA’s Figure 1.4 from its World Energy Outlook 2015, showing how much oil can be produced at various price levels.

With close to another decade of experience, it has become clear that high oil prices don’t “stick” very well. The economy then slides into recession, or some other adverse event takes place, bringing oil prices back down again. The relatively low maximum to fossil fuel prices tends to lead to a much earlier end to fossil fuel extraction than most analyses of available resource amounts would suggest.

OPEC+ tends to reduce supply because they find prices too low. US drillers of oil from shale formations (tight oil in Figure 4) have been reducing the number of drilling rigs because oil prices are not high enough to justify more investment. Politicians know that voters dislike inflation, so they take actions to hold down fossil fuel prices. All these approaches tend to keep oil prices low, and indirectly put a cap on output.

Why Indications from EROEI Analyses Don’t Work for Electrification of the Economy

[5] Energy Return on Energy Invested (EROEI) analyses were not designed to analyze the situation of a massive scaling up of wind and solar, as some people are now considering. If utilized for this purpose, they provide a far too optimistic an outlook for renewables.

The EROEI calculation compares the energy output of a system to the energy input of the system. A high ratio is good; a low ratio tends to be a problem. As I noted in the introduction, published EROEIs of wind and solar are prepared as if they are to be only a very small part of electricity generation. It is assumed that other types of generation can essentially provide free balancing services for wind and solar, even though doing so will adversely affect their own profitability.

A recent review paper by Murphy et al. seems to indicate that wind and solar have favorable EROEIs compared to those of coal and natural gas, at point of use. I don’t think that these favorable EROEIs really mean very much when it comes to the feasibility of scaling up renewables, for several reasons:

[a] The pricing scheme generally used for wind and solar electricity tends to drive out other forms of electrical generation. In most places where wind and solar are utilized, the output of wind and solar is given priority on the grid, distorting the wholesale prices paid to other providers. When high amounts of wind or solar are available, wind and solar generation are paid the normal wholesale electricity price for electricity, while other electricity providers are given very low or negative wholesale prices. These low prices force other providers to reduce production, making it difficult for them to earn an adequate return on their investments.

This approach is unfair to other electricity providers. It is especially unfair to nuclear because most of its costs are fixed. Furthermore, most plants cannot easily ramp electricity production up and down. A recently opened nuclear plant in Finland (which was 14 years behind plan in opening) is already experiencing problems with negative wholesale electricity rates, and because of this, is reducing its electricity production.

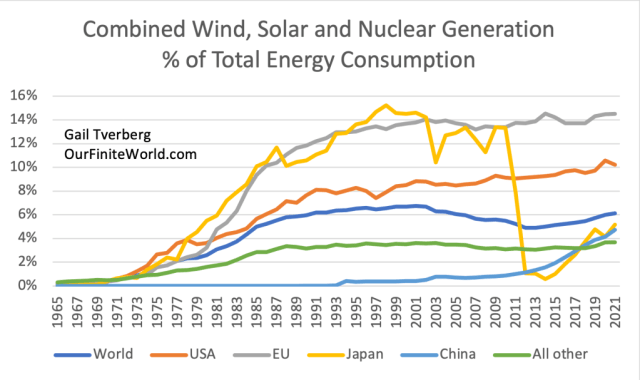

Historical data shows that the combined contribution of wind, solar, and nuclear doesn’t necessarily increase the way that a person might expect if wind and solar are truly adding to electricity production. In Europe, especially, the availability of wind and solar seems to be being used as an excuse to close nuclear power plants. With the pricing scheme utilized, plants generating nuclear energy tend to lose money, encouraging the owners of plants to close them.

Figure 5. Combined wind, solar and nuclear generation, as a percentage of total energy consumption, based on data from BP’s 2022 Statistical Review of World Energy. The IEA and BP differ on the approach to counting the benefit of wind and solar; this figure uses the IEA approach. The denominator includes all energy, not just electricity.

The US has been providing subsidies to its nuclear plants to prevent their closing. When one form of electricity gets a subsidy, even the subsidy of going first, other forms of electricity seem to need a subsidy to compete.

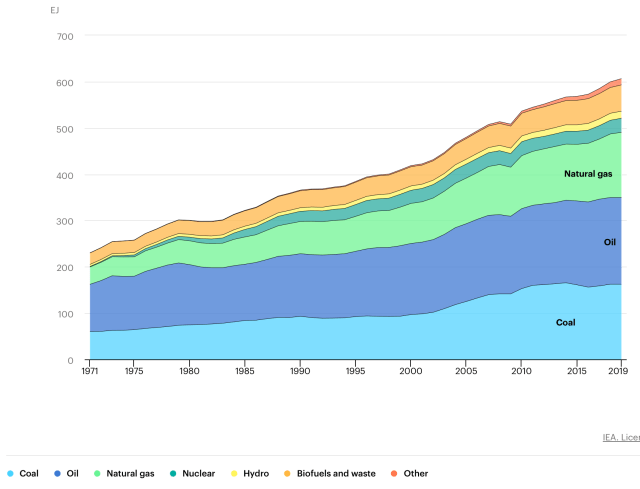

[b] Small share of energy supply. Based on Figure 5, the total of wind, solar, and nuclear electricity only provides about 6.1% of the world’s total energy supply. An IEA graph of world energy consumption (Figure 6) doesn’t even show wind and solar electricity separately. Instead, they are part of the thin orange “Other” line at the top of the chart; nuclear is the dark green line above Natural Gas.

Figure 6. Chart prepared by the International Energy Association showing energy consumption by fuel through 2019. Chart is available through a Creative Commons license.

Given the tiny share of wind and solar today, ramping them up, or those fuels plus a few others, to replace all other energy supplies seems like it would be an amazingly large stretch. If the economy is, in fact, much like a human in that it cannot substantially reduce energy consumption without collapsing, drastically reducing the quantity of energy consumed by the world economy is not an option if we expect to have an economy remotely like today’s economy.

[c] Farming today requires the use of oil. Transforming farming to an electrical operation would be a huge undertaking. Today’s farm machinery is mostly powered by diesel. Food is transported to market in oil-powered trucks, boats, and airplanes. Herbicides and pesticides used in farming are oil-based products. There is no easy way of converting the energy system used for food production and distribution from oil to electricity.

At a minimum, the entire food production system would need to be modeled. What inventions would be needed to make such a change possible? What materials would be required for the transformation? Where would all these materials come from? How much debt would be required to fund this transformation?

The only thing that the EROEI calculation could claim is that if such a system could be put in place, the amount of fossil fuels used to operate the system might be low. The overwhelming complexity of the necessary transformation has not been modeled, so its energy cost is omitted from the EROEI calculation. This is one way that calculated EROEIs are misleadingly optimistic.

[d] EROEI calculations do not include any energy usage related to the storage of electricity until it is needed. Solar energy is most available during the summer. Thus, the most closely matched use of solar electricity is to power air conditioners during summer. Even in this application, several hours’ worth of battery storage are needed to make the system work properly because air conditioners continue to operate after the sun sets. Also, people who come home from work need to cook dinner for their families, and this takes electricity. Energy costs related to electricity storage are not reflected in the EROEIs shown in published summaries such as those of the Murphy analysis.

A much more important need than air conditioning is the need for heat energy in winter to heat homes and offices. Neither wind nor solar can be counted upon to provide electricity when it is cold outside. One workaround would be to greatly overbuild the system, so that there would be a better chance of the renewable source producing enough electricity when it is needed. Adding several days of storage through batteries would be helpful too. An alternate approach would be to store excess electricity indirectly, by using it to produce a liquid such as hydrogen or methanol. Again, all of this becomes complex. It needs to be tried on small scale, and the real cost of the full system determined.

Both the need to overbuild the system and the need to provide storage are excluded from EROEI calculations. These are yet other ways that EROEI calculations provide an overly optimistic view of the value of wind and solar.

[e] Long distance travel. We use oil products for long distance transport by ship, air, truck, and train. If changes are to be made to use electricity or some sort of “green fuels,” this is another area where the entire change would need to be mapped out for feasibility, including the inventions needed, the materials required, and the debt this change would entail. What timeframe would be required? Would there be any possibility of achieving the transformation by 2050? I doubt it.

The conversion of all transportation to green energy is very much like the needed conversion of the food system from oil to electricity, discussed in [5c], above. Huge complexity is involved, but the energy cost of this added complexity has been excluded from EROEI calculations. This further adds to the misleading nature of EROEI indications for renewables.

[f] A dual system is probably needed. Even if it makes sense to ramp up wind and solar, there still will be a need for many products that are today made with fossil fuels. Fossil fuels are used in paving roads and for making lubrication for machines. Herbicides, insecticides, and pharmaceutical products are often made from fossil fuels. Natural gas is often used to make ammonia fertilizer. Fabrics and building materials are often made using fossil fuels.

Thus, it is almost certain that a dual system would be needed, encompassing both fossil fuels and electricity. There are likely to be inefficiencies in such a dual system. If intermittent renewables such as wind and solar are to be a major part of the economy, this inefficiency needs to be part of any model and needs to be reflected in EROEI calculations.

[g] “Renewable” devices are not themselves recyclable. Instead, they present a waste disposal problem. Solar panels especially present a toxic waste problem. Without much recycling, there is a long term need for minerals of many types to be extracted and transported around the world. These issues are not considered in modeling.

Profitability of Unsubsidized Renewables Is the Best Measure

[6] If renewables are to be truly useful to the system, they need to be so profitable that their profits can be taxed at a high rate. Furthermore, sufficient funds should be left over for reinvestment. The fact that this is not happening is a sign that renewables are not truly helpful to the economy.

Some people talk about the need for “surplus energy” from energy sources to power an economy. I connect this surplus energy with the ability of any energy source to generate income that can be taxed at a fairly high rate. In fact, I gave a talk to the International Society for Biophysical Economics on September 7, 2021, called, To Be Sustainable, Green Energy Must Generate Adequate Taxable Revenue.

The need for surplus energy that can be transferred to the government is closely connected with the debt problem that occurs when oil prices are higher than about $20 per barrel that I noted in Section [1] of this post. Renewable energy must be truly inexpensive, with all storage included, to be helpful to the economy. It must be affordable to citizens, without subsidies. The cost structure must be such that the renewable energy generates so much profit that it can pay high taxes. It is unfortunately clear that today’s renewables are too expensive for the US economy.

EROEI Models Can’t Tell Us as Much as We Would Like

[7] In the real economy, the economy builds up in small pieces, as new approaches prove to be profitable and as all the necessary components prove to be available. EROEI models shortcut this process, but they can easily be misleading.

The concept of Energy Return on Energy Invested has been used for many years in the field of biology. For example, we can compare the energy a fish gets from the food it eats to the energy the fish expends swimming to procure that food. The fish needs to get sufficient energy value from the food it eats to be able to cover the energy expended on the swim, plus a margin for other bodily functions, including reproduction.

Professor Charles Hall (and perhaps others) adapted this concept for use in comparing different energy “extraction” (broadly defined) techniques. More recent researchers have tried to extend the calculation to include energy costs of delivery to the user.

The adaptation of the biological concept of EROEI to the various processes associated with energy extraction works in some respects but not in others. The adaptation clearly works as a tool for teaching diminishing returns. It gives reasonable information for comparing oil wells to each other, or solar panels to other solar panels. But I don’t think that EROEI comparisons across energy types works well at all.

One issue is that there are huge differences in the selling prices of different types of energy. These are ignored in EROEI calculations, making it look feasible to use a high-priced type of energy (such as oil) to produce a low-valued type of output (intermittent electricity from wind turbines or solar panels). If profitability calculations were made instead, without mandates or subsidies (including the subsidy of going first), the extent to which there is a favorable return would become clear.

Another issue is that intermittency of wind and solar adds huge costs to the system, but these are ignored in EROEI calculations. (The situation is somewhat like having workers drop in and leave according to their own schedules, rather than working during the schedule the employer prefers.) In EROEI calculations, the assumption usually made is that the fossil fuel system will provide free balancing services by operating their electricity generation systems in an inefficient manner. In fact, this is the assumption made in the Murphy paper cited previously.

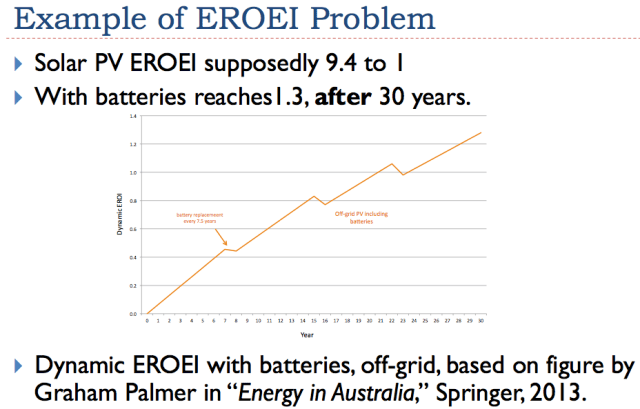

An analysis by Graham Palmer gives some insight regarding the high energy cost of adding battery backup (Figure 7).

Figure 7. Slide based on information in the book, “Energy in Australia,” by Graham Palmer. His chart shows “Dynamic Energy Returned on Energy Invested.”

In Figure 7, Palmer shows the pattern of energy investment and energy payback for a particular off-grid home in Australia which uses solar panels and battery backup. His zig-zag chart reflects two offsetting impacts:

(a) Energy investment was required at the beginning, both for the solar panels and for the first set of batteries. The solar panels in this analysis last for 30 years, but the batteries only last for 7.5 years. As a result, it is necessary to invest in new batteries, three additional times over the period.

(b) Solar panels only gradually make their payback.

Palmer finds that the system would be in a state of energy deficit (considering only energy out versus energy in) for 20 years. At the end of 30 years, the combined system would return only 1.3 times as much energy as the energy invested in the system. This is an incredibly poor payback! EROEI enthusiasts usually look for a payback of 10 or more. The solar panels in the analysis were close to this target level, at 9.4. But the energy required for the battery backup brought the EROEI down to 1.3.

Palmer’s analysis points out another difficulty with wind and solar: The energy payback is terribly slow. If we burn fossil fuels, the economy gets a payback immediately. If we manufacture wind turbines or solar panels, there is a far longer period of something that might be called, “energy indebtedness.” EROEI calculations conveniently ignore interest charges, again making the situation look better than it really is. The buildup in debt is also ignored.

Thus, even without the issue of scaling up renewables if we are to make a transition to energy system more focused on electricity, EROEI calculations are set up in a way that make intermittent renewable energy look far more feasible than it really is. “Energy Payback Period” is another similar metric, with similar biases.

The fact that these metrics are misleading is difficult to see. Very inexpensive fossil fuels pay back their cost many times over, in terms of societal gain, virtually immediately. Wind turbines and solar panels depend upon the generosity of the fossil fuel system to get any payback at all because intermittent electricity cannot support an economy like today’s economy. Even then, the payback is only available over a period of years.

I am afraid that the only real way of analyzing the feasibility of scaling up electricity using wind and solar is by looking at whether they can be extraordinarily profitable, without subsidies. If so, they can be highly taxed and end our government debt problem. The fact that wind and solar require subsidies and mandates, year after year, should make it clear that they aren’t solutions.

By Gail Tverberg

More Top Reads From Oilprice.com: