UK property sellers 'too optimistic' as asking prices hit new record high

UK property sales and asking prices both hit new record highs last month, new figures show as a housing market boom continues despite the economic toll of the pandemic.

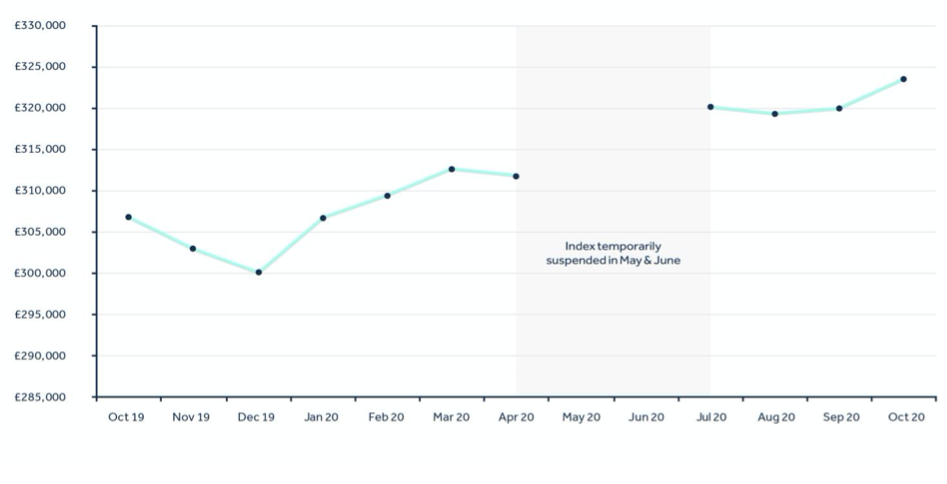

Data from property listings site Rightmove (RMV.L) shows sales were up 70% in September versus a year earlier, and average asking prices up 5.5% or almost £17,000 ($22,000) year-on-year in October. It marked the highest annual price growth in four years.

The average property on the market earlier this month was on for an all-time high of £323,530, also marking a 1.1% increase on prices last month.

But estate agents say some owners are “now getting too optimistic” with asking prices, and there are some signs of market momentum “easing off” this month.

The property boom since the market re-opened earlier this year has continued in spite of the resurgent coronavirus, tighter lockdown restrictions, rising unemployment and Brexit uncertainty, with some experts calling it a “paradox.”

Stamp duty cuts, pent-up demand since the first nationwide lockdown and new interest in moving are widely seen to be fuelling the market, while mortgage holidays, low interest rates and the furlough scheme have limited the hit from COVID-19 and government restrictions.

READ MORE: House prices up 7.3% as mortgage applications hit 12-year high

“The forecasting rulebook has been rewritten in this extraordinary year, with predictions of a post-lockdown price plunge in Q3 failing to materialise, and Rightmove’s original forecast in December last year of a 2% annual rise for 2020 being too timid,” said Rightmove’s latest house price index report published on Monday.

The report detailed how activity has burst multiple Rightmove records, on top of new highs for sale numbers and prices:

The average time to sell hit a record low 50 days, 12 days faster than the same period a year earlier.

Estate agents have more properties marked as sold than as available for sale for the first time ever.

Meanwhile Rightmove traffic saw its biggest year-on-year traffic leap in 14 years, up 49% in September. The number of sales agreed this year so far is also now 2% higher than last year, despite months of heavily limited activity earlier this year due to government restrictions.

READ MORE: Estate agents expect prices to be higher in a year despite crisis

“Previous records are tumbling in this extraordinary market, and there are still some legs left in the upwards march of property prices,” said Tim Bannister, Rightmove’s director of property data.

“Many buyers seem willing to pay record prices for properties that fit their changed post-lockdown needs, though agents are commenting that some owners’ price expectations are now getting too optimistic, and not all properties fit the must-have template that buyers are now seeking.”

He added that market activity even appeared to remain “high” in areas with higher infection rates and stricter localised lockdown rules.

WATCH: What stamp duty cuts mean for the market short- and long-term

Martin Robinson, director of Hunters estate agents, said: “We would normally see a slowing of the market as the nights draw in, but the appetite to take full advantage of the low interest rates and a stamp duty holiday means activity continues to grow.”

Dominic Agace, chief executive of Winkworth estate agents, said the trend would persist for buyers looking for more space to work from home, and he expected the “brisk” market to last for the rest of the year.

But he added: “With increasing supply and uncertainty around Covid, we expect prices to flatten out now we are past the peak autumnal market.”

READ MORE: Generation Buy: What low-deposit mortgage plans mean for first-time buyers