Triton (TRTN) Rides on Dividends & Buybacks Amid Rising Costs

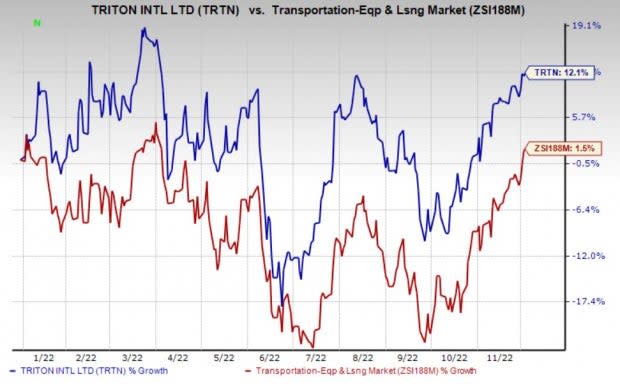

Triton International Limited TRTN is benefiting from shareholder-friendly initiatives adopted by the company. These initiatives not only instill investors’ confidence but also positively impact earnings per share. Notably, shares of Triton have gained 12.1% so far this year, outperforming 1.5% growth of the industry it belongs to.

Image Source: Zacks Investment Research

The company recently reported third-quarter 2022 earnings of $2.88 per share, which surpassed the Zacks Consensus Estimate of $2.76. The bottom line jumped 18.5% year over year, owing to strong trade volumes and container demand.

Total leasing revenues of $424.7 million beat the Zacks Consensus Estimate of $420.6 million. The top line increased 6.1% year over year, driven by a 95.6% rise in revenues from finance leases. Revenues from operating leases (accounting for 93% of the top line) grew 2.6% year over year.

Triton International Limited Price, Consensus and EPS Surprise

Triton International Limited price-consensus-eps-surprise-chart | Triton International Limited Quote

How is Triton Placed?

We are impressed with Triton's efforts to reward its shareholders through dividends and buybacks. Concurrent with its third-quarter 2022 earnings release, Triton’s board of directors increased its quarterly cash dividend from 65 cents per share to 70 cents, indicating a dividend hike of almost 8%. The company repurchased 3.2 million shares during the third quarter and repurchased an additional 0.9 million shares through Oct 26, 2022. Such shareholder-friendly moves indicate the company’s commitment to create value for shareholders and underline its confidence in its business.

Gradual increases in trade volumes and container demand bode well for the company. Evidently, earnings per share in the first nine months of 2022 increased 31.7% year over year, owing to strong trade volumes and container demand.

On the flip side, Triton International's bottom-line growth is being limited by high administrative expenses. Administrative expenses increased in the first nine months of 2022 as well, leading to a 5.6% uptick in operating costs.

Zacks Rank and Stocks to Consider

Currently, Triton carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks from the broader Zacks Transportation sector are Air Transport Services Group ATSG, Ryder Systems R and Teekay Tankers Ltd. (TNK), each currently carrying a Zacks Rank #2 (Buy).

ATSG has an expected earnings growth rate of 34.34% for the current year. ATSG delivered a trailing four-quarter earnings surprise of 17.78%, on average.

The Zacks Consensus Estimate for ATSG’s current-year earnings has improved 5.2% over the past 90 days. Shares of ATSG have gained 7.9% over the past year.

Ryder has an expected earnings growth rate of 67.12% for the current year. R delivered a trailing four-quarter earnings surprise of 30.13%, on average.

The Zacks Consensus Estimate for R’s current-year earnings has improved 6.9% over the past 90 days. Shares of R have gained 12.7% over the past year.

Teekay Tankers has an expected earnings growth rate of 214.91% for the current year. TNK delivered a trailing four-quarter earnings surprise of 42.23%, on average. Teekay Tankers has a long-term expected growth rate of 3%.

The Zacks Consensus Estimate for TNK’s current-year earnings has improved 95% over the past 90 days. Shares of TNK have soared 190% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

Triton International Limited (TRTN) : Free Stock Analysis Report