Thousands of Scottish workers will pay more income tax than rest of UK

Hundreds of thousands of workers in Scotland will be paying more income tax than their counterpart elsewhere in the UK from next year.

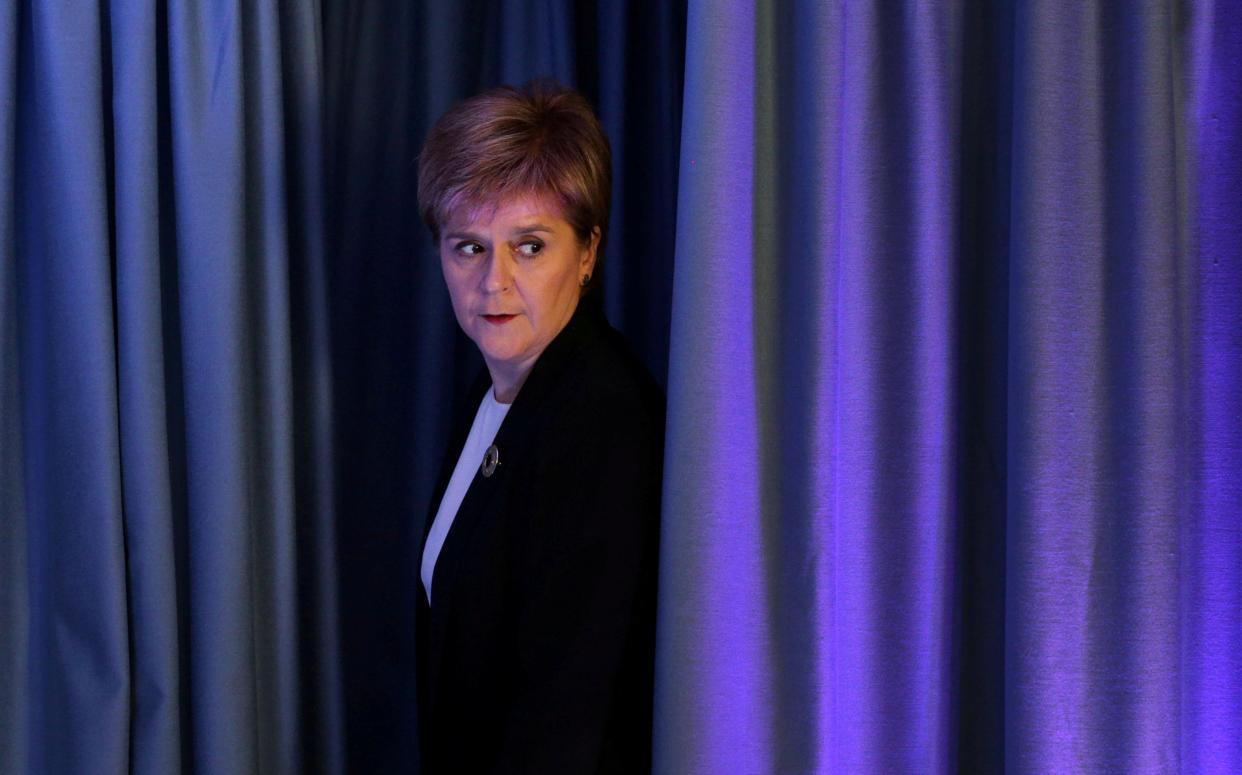

Three out of ten taxpayers in Scotland could be facing a rise in their bills after Thursday’s Scottish Budget, Nicola Sturgeon, the First Minister, has indicated.

The country’s finance secretary, Derek Mackay, announced a new tax band of 21p for those earning more than £24,000.

MORE: British workers’ pay will be ‘astonishingly’ bad for decades, experts warn

But a starter rate of 19p in the pound will also be introduced, Mackay confirmed in his draft budget.

The higher rate of tax will be increased from 40p to 41p and the top rate from 45p to 46p.

Mackay said the move would mean no one earning less than £33,000 in Scotland will pay more tax.

MORE: Scotland can introduce minimum alcohol pricing, Supreme Court rules

Sturgeon said her government would seek to “protect those on low and middle incomes”. She defended the income tax rises, saying Tory cuts had left a £200m hole in the Scottish budget.

“The proposals we put forward this afternoon will set out how we protect our NHS our education system and other vital public services from that, while protecting the vast majority of tax payers and also investing in business and the economy,” she said.

New Scottish income tax bands

19% rate: on income between £11,851 to £13,850.

20% rate on income between £13,851 to £24,000.

21% rate: on income between £24,401 to £44,273.

44% rate: on income between £44,274 to £150,000.

46% rate: on income over £150,000.

Income tax rates for the rest of the UK

20% rate: on income between £11,850 to £46,350.

40% rate: on income between £46,351 to £150,00.

45% rate: on income over £150,000.