S&P takes over IHS Markit for $44bn in second largest deal of 2020

Ratings giant S&P Global (SPGI) has confirmed it will takeover IHS Markit (INFO) for $44bn (£33bn), merging two of Wall Street’s data giants in the second biggest deal of the year.

Under the terms of the agreement, which includes $4.8bn of debt, each IHS Markit share will be exchanged for a fixed ratio of 0.2838 shares of S&P stock, the two companies said in a statement.

Once the deal is finalised, S&P shareholders will own around 67.75% of the combined company on a fully diluted basis, while IHS shareholders will own about 32.25%.

It will be the second largest deal to be conducted in 2020, according to data compiled by Bloomberg, coming in second to the $56bn set of transactions among China’s biggest oil and gas companies to sell their pipeline networks to a new national carrier.

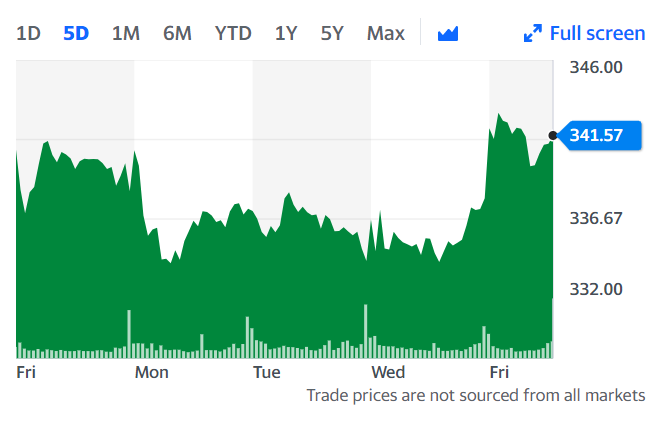

IHS Markit was valued at $36.9bn at Friday’s close in New York, after climbing to a record high earlier in the week.

Announcing the deal, the groups said in a statement: “The transaction brings together two world-class organisations, a unique portfolio of highly complementary assets in attractive markets and cutting-edge innovation and technology capability to accelerate growth and enhance value creation.”

Douglas Peterson, president and chief executive of S&P Global, will remain at the helm of the combined company, while Lanca Uggla, chairman and chief executive of IHS Markit, will stay on as an adviser for a year after the transaction closes.

Peterson said: “We are confident that the strengths of S&P Global and IHS Markit will enable meaningful growth and create attractive value for all stakeholders. We have been impressed by the IHS Markit team and look forward to welcoming the talented IHS Markit employees to S&P Global.”

READ MORE: British deals slump during lockdown as firms pause M&A

According to financial data provider Refinitiv data, deals in the three months to September 2020 hit a record high, with more than $1tn worth of transactions.

The tie-up follows the London Stock Exchange Group (LSE.L) agreeing to acquire Refinitiv last year for $27bn. The LSE is still negotiating with European Union regulators over the deal and is in the final stage of trying to win clearance.

S&P Global is renowned for providing debt ratings to countries and companies, as well as data on capital and commodity markets worldwide.

Meanwhile IHS Markit, established in 2016, is known for its monthly purchasing managers’ index (PMI) surveys, which are among the closest-watched and quickest indicators of private sector activity.

Watch: Why can't governments just print more money?