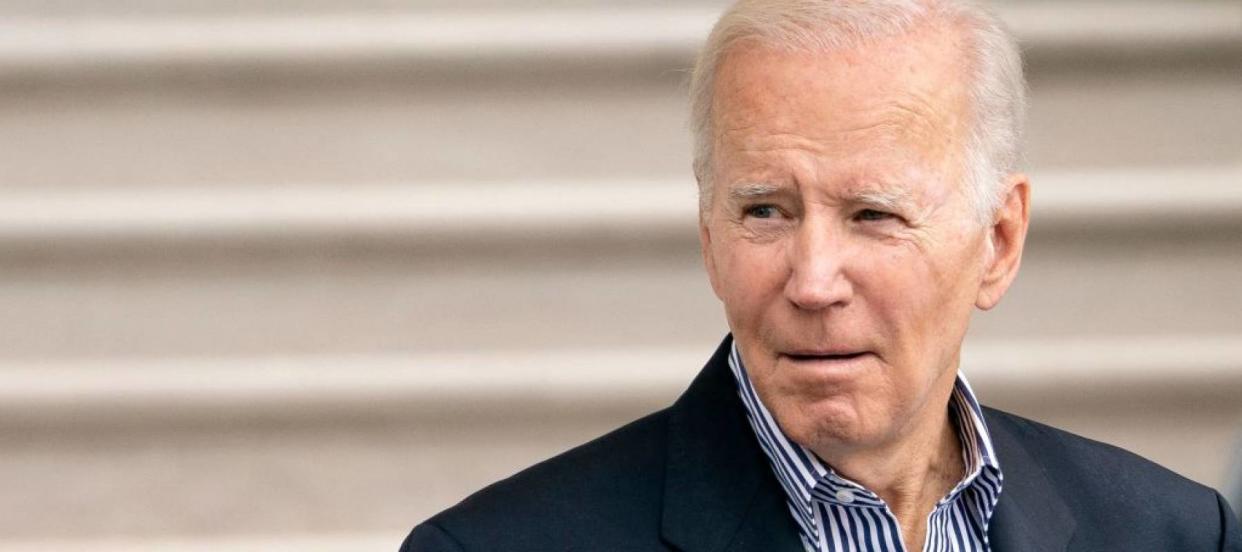

'Remarkable reversal': President Biden just (quietly) scaled back student loan forgiveness — and the change could impact up to 1.5M borrowers. Are you one of them?

The Department of Education reversed course last week by quietly scaling back on eligibility for President Biden’s student loan forgiveness plan.

Borrowers with certain loans issued and managed by private lenders but guaranteed by the government now will not be able to receive relief under the new guidelines, which were updated on the department’s website at the end of September.

This "remarkable reversal," as NPR put it, could affect hundreds of thousands of borrowers. And with legal disputes being launched, the future of forgiveness seems less certain than when it was announced six weeks ago.

Don't miss

If you owe $25K+ in student loans, there are ways to pay them off faster

Too many Americans are still missing out on cheaper car insurance

A TikToker paid off $17,000 in credit card debt by 'cash stuffing' — can it work for you?

Hundreds of thousands of borrowers will be affected

Biden’s student loan forgiveness plan made waves when it was first announced in August, with the promise that billions of dollars were about to be wiped from student loan records.

The department’s website originally stated that borrowers with privately held federal student loans, such as through the Federal Family Education Loan (FFEL) and Perkins programs, could receive relief by consolidating these loans into the Direct Loan program.

However, the guidance now specifies, that consolidation loans comprised of any FFEL or Perkins loans that aren’t held by the Education Department are only eligible for forgiveness if the borrower applied for consolidation before Sept. 29, 2022.

The FFEL program was shuttered in 2010, but an administration official told NPR about 800,000 borrowers would now be excluded from relief.

And even more people could be affected by receiving less relief as there are 1.5 million borrowers who have both Direct Loans (which do qualify for cancellation) and FFEL loans.

What could have triggered the reversal?

While the Department of Education (ED) made no explanation for narrowing the eligibility requirements on its website, a spokesperson provided NPR with a statement declaring its goal was to “provide relief to as many eligible borrowers as quickly and easily as possible.”

The statement went on to add that this move will allow the ED to achieve that goal while it continues to explore “additional legally-available options to provide relief” to the borrowers now excluded from forgiveness.

Read more: Do you fall in America's lower, middle, or upper class? How your income stacks up

According to the department’s website, it’s currently reviewing its options and in discussions with private lenders to find a way to offer relief to borrowers with federal student loans not held by the ED, including FFEL Program loans and Perkins Loans.

Based on the statement provided to NPR, that may mean FFEL borrowers could receive one-time debt relief without having to consolidate.

Pushback against forgiveness intensifies

The move from the ED happened on the same day that six Republican-led states announced they would be suing the Biden administration over the plan, accusing it of overstepping its executive powers. They allege that Missouri's loan servicer is facing a “number of ongoing financial harms” by losing revenue from FFEL loans.

And earlier in the week, Sacramento law firm Pacific Legal Foundation filed a suit against the U.S. Department of Education over the potential tax liability for Americans.

The plaintiff — a lawyer with the foundation — argues that under his current Public Service Loan Forgiveness plan, he’ll already have his debts canceled after he’s made payments for 10 years. And on top of that, with Biden’s forgiveness plan, he’ll be saddled with an additional state tax bill which he wouldn’t have under his current plan.

That being said, the Biden administration has indicated that borrowers can choose to opt out of the forgiveness plan if they wish.

In the meantime, applications for those who are eligible for debt forgiveness are expected to open sometime in early October and be available until December 31, 2023. Borrowers eager to get their applications in can also sign up for email updates.

What to read next

'I just can't wait to get out': Nearly three-quarters of pandemic homebuyers have regrets — here's what you need to know before you put in that offer

House Democrats have officially drafted a bill that bans politicians, judges, their spouses and children from trading stocks — but here's what they're still allowed to own and do

Biggest crash in world history': Robert Kiyosaki issues another dire warning and now avoids ‘anything that can be printed’ — here are 3 hard assets he likes instead

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.