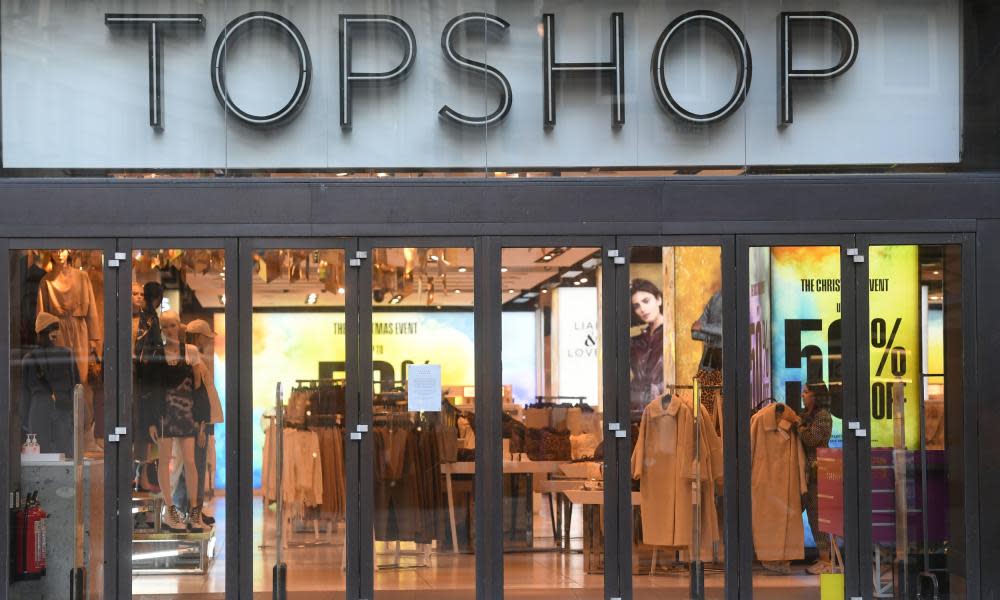

Next drops bid to buy Topshop after Arcadia's breakup

Next has pulled out of the race to acquire Topshop, the jewel in the crown of Sir Philip Green’s collapsed fashion empire Arcadia, after rival bidders trumped its offer.

Arcadia, which employed 13,000 people across 500 outlets when it fell into administration last year, is being broken up. Interested parties had been asked to submit bids for the whole company or individual brands at the start of this week.

Next, which was working with the US hedge fund Davidson Kempner, said it had “withdrawn from the process to acquire any or all of the Arcadia Group from the administrator”.

In a statement the FTSE 100 company added “our consortium has been unable to meet the price expectations of the vendor” and wished the future owners well in their endeavours to “preserve an important part of the UK retail sector”.

The Next consortium was pitted against Shein, a Chinese online fashion retailer and Authentic Brands, the US owner of the Barneys department store, which has been linked to a joint bid with JD Sports. The online retailers Asos and Boohoo are also thought to be involved in the mix.

Shein tabled an offer worth in excess of £300m for Topshop and Topman, according to Sky News which first reported the development. It added that a separate process was being run for other Arcadia brands such as Burton and Dorothy Perkins.

Arcadia, which Green bought for £850m in 2002, is home to a stable of household names including Topshop, Topman, Dorothy Perkins, Wallis, Miss Selfridge and Burton. Evans, its plus-size clothing brand, has already been hived off and sold to City Chic Collective, an Australian retailer, for £23m.

Arcadia has been the biggest corporate casualty of the pandemic, which has hammered high street retailers. The high street closures proved to be the final straw for the group, which had suffered years of flagging sales amid heavy competition from rivals such as Boohoo and Primark. It only narrowly avoided administration in 2019 after landlords agreed rent reductions and store closures.

In the wake of the BHS scandal, which saw Green eventually agreeing to pay £363m into the company’s depleted pension pot, the failure of Arcadia has thrown the spotlight on its own scheme, which has an estimated £350m deficit. The family made a promised £50m payment a year early and has also signed over some Arcadia property assets – but it is not yet clear whether it will be enough to fill the hole.