Market Wrap: Crypto Sell-Off Stabilizes Amid Bearish Sentiment

Don't miss CoinDesk's Consensus 2022, the must-attend crypto & blockchain festival experience of the year in Austin, TX this June 9-12.

Bitcoin (BTC) stabilized around $36,000 and was roughly flat on Friday. The cryptocurrency traded with lower volatility over the past 24 hours, compared with yesterday's sharp sell-off in price.

Alternative cryptos (altcoins) were also relatively stable on Friday, although GALA rose by as much as 9%, outperforming other tokens on the CoinDesk 20 list. Also, Algorand's ALGO token was up by 12% over the past 24 hours.

Choppy price action over the past week continued to reflect uncertainty among traders, especially as macroeconomic risks linger.

Just launched! Please sign up for our daily Market Wrap newsletter explaining what happens in crypto markets – and wh

On Thursday, the Bank of England (BOE) hiked interest rates and warned the public about an economic downturn. That triggered fears of stagflation, or high inflation and slow economic growth, among investors. The BOE's grim outlook was the opposite of the U.S. Federal Reserve's upbeat tone on Wednesday, which temporarily assured investors that U.S. economic conditions could withstand higher rates.

Overall, the shift from accommodative monetary policy to more restrictive measures has led to an unwind of speculative activity among global investors. That could be headwind for stocks and cryptos this year.

Over the short term, price action remains neutral, and some altcoins have benefited from brief price spikes.

Latest prices

●Bitcoin (BTC): $35,928, −0.71%

●Ether (ETH): $2,683, −1.28%

●S&P 500 daily close: $4,123, −0.57%

●Gold: $1,883 per troy ounce, +0.47%

●Ten-year Treasury yield daily close: 3.12%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

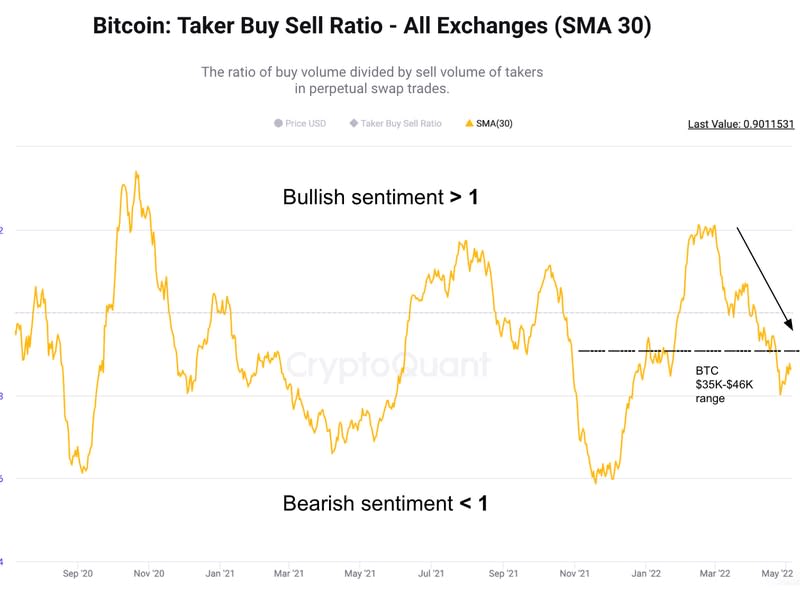

The chart below shows the ratio of buy volume versus sell volume in the bitcoin perpetual futures market. Readings below one indicate bearish sentiment among traders, similar to what occurred during previous downturns in price.

BTC's latest price range between $35,000 and $46,000 occurred alongside a persistent downtrend in the buy/sell volume ratio. That suggests some buyers have remained on the sideline despite short-term stabilization in price.

Ether holding up versus bitcoin

Ether (ETH) is down by 4% over the past week, compared with a 6% decline in BTC.

Typically, ETH underperforms BTC during down markets. This time, however, choppy trading conditions have capped the ETH/BTC ratio in a tight range over the past year. A decisive breakout or breakdown from the current range could confirm a risk-on or risk-off environment.

Bitcoin's dominance ratio, or BTC's market cap relative to the total crypto market cap, ticked lower over the past few days. That suggests altcoins have experienced less selling pressure relative to bitcoin, which means traders are still comfortable with additional risk.

Altcoins decline less than bitcoin during rising markets because of their higher risk profile. Still, similar to the BTC/ETH price ratio, a breakout or breakdown in the dominance ratio would confirm the next phase for crypto markets.

Altcoin roundup

DeFi tokens underperform: April fared relatively well for memecoins, such as dogecoin (DOGE) and shiba inu (SHIB), but marked big losses for decentralized finance (DeFi) tokens, including aave (AAVE) and thorchain (RUNE), research by crypto exchange Kraken noted this week. Considering bitcoin’s (BTC) 17% loss as a benchmark, the broader DeFi sector lost 34% on average, closely followed by tokens of layer 1, or base blockchains, at 33%. Read more here.

$36 million in seized JUNO tokens moved to wrong wallet: Validators, developers and token holders are grappling with who is to blame for the copy-paste error that moved the tokens to an address no one can access. In a world where “code is law,” a simple community vote should have been enough to move tokens from one specific blockchain address to another, according to CoinDesk's Sam Kessler. Read more here.

Curve Finance integrates with Near’s Aurora network: Aurora is an EVM built on the Near protocol, offering full Ethereum compatibility, low transaction costs and trustless bridging, according to its website. The integration allows users to connect to the Aurora network on their Ethereum wallets like MetaMask when using Curve and access the decentralized application's liquidity pools, according to the press release. Read more here.

Relevant insight

Listen 🎧: The CoinDesk Markets Daily podcast discusses the future of media subscriptions, and BTC's rough trading week.

US Jobs Report Shows Gain of 428,000, Adding to Price Pressures: Friday's Labor Department report showed that employment growth stayed robust last month, at a level that should continue to worry the Federal Reserve about a too-tight labor market.

Nvidia Failed to Disclose Cryptomining Revenue Impact in 2018, SEC Says: Without admitting or denying the charges, the chipmaker agreed to pay a $5.5 million dollar fine to settle the affair.

US Officials Add North Korea-Linked Bitcoin Mixer, More BTC and ETH Addresses to Sanctions List: The U.S. Treasury Department is ramping up efforts to ice the flow of stolen crypto from a historic $620 million hack.

The NY Mining Moratorium’s Odds Just Got a Lot Worse: The Senate Environmental Conservation Committee will not consider the controversial bill, according to a schedule released Thursday.

US Court Orders BitMEX Founders to Pay $30M for Illegal Trading: The three co-founders, Arthur Hayes, Benjamin Delo and Samuel Reed, must each pay $10 million, the CFTC said.

Argentina's Central Bank Bans Lenders From Offering Crypto Services: The announcement on Thursday afternoon comes after the IMF last month approved a $45 billion loan facility for Argentina that stipulated the country would discourage the use of cryptocurrencies.

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Biggest Gainers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Algorand | +11.7% | ||

EOS | +1.1% | ||

XRP | +0.7% |

Biggest Losers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Dogecoin | −2.0% | ||

Solana | −1.9% | ||

Cardano | −1.3% |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.