Lloyds beats forecasts and returns to profit in third quarter

Lloyds Bank (LLOY.L) has returned to profit, recovering from an unexpected loss in the first half of the year.

Lloyds Bank on Thursday said it made a pre-tax profit of £1bn ($1.3bn) in the third quarter on income of £3.4bn. Analysts had forecast a profit of £588m on income of £3.3bn.

The performance marks a return to the black for Lloyds after an unexpected first-half loss. Lloyds was pushed into the red by larger-than-expected loss provisions to cover loans going bad due to the COVID-19 pandemic.

READ MORE: HSBC axes 6,000 jobs so far this year as cost cutting accelerates

The bank set aside another £301m in the third quarter to cover bad loans, but this was significantly below the charge taken in the second quarter and below analysts’ forecasts. It takes the total provisions built up by the bank so far this year to £4.1bn.

Lloyds said loss provisions for the full-year were now likely to be “at the low end” of the £4.5bn to £5.5bn range provided earlier this year.

“Although our performance has clearly been impacted by the pandemic and the associated challenging economic environment, I am pleased that we are now seeing an encouraging business recovery and, with impairments significantly lower, a return to profitability in the third quarter,” chief executive António Horta-Osório said in a statement.

Horta-Osório said the UK economy had performed much better than Lloyds had expected in the third quarter, which boosted the bank.

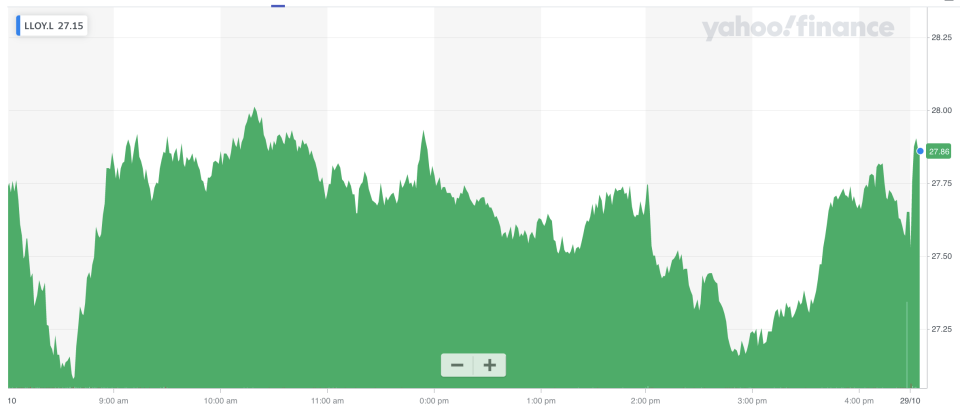

Shares in Lloyds rose 1% at the open in London.

Lloyds joins rivals Barclays (BARC.L) and HSBC (HSBA.L) in announcing forecasting-beating third quarter numbers. While rivals were boosted by their markets and investment banking businesses, the more domestically-focused Lloyds benefited from a boom in the UK property market.

Mortgage lending rose by £3.5bn, with highest level of first time buyer and home mover activity since 2008.

“The housing market in general is significantly stronger than what everyone would have anticipated six months ago,” Horta-Osório told journalists on an earnings call.

He said activity was boosted by pent-up demand and a temporary cut to Stamp Duty, as well as what he called “a structural shift in customer behaviour”.

Watch: What is a V-shaped economic recovery?

READ MORE: HSBC plans 'conservative' dividend after better-than-expected quarter

“Most people spend much more time at home so they also want to live in bigger homes, preferably outside cities, and they have been moving up as well,” Horta-Osório said.

In June, Lloyds said it expected house prices to fall for at least the next 12 months. It scrapped that forecast on Thursday, saying prices were likely to continue growing until the middle of next year before dipping this time next year.

Alongside a better outlook for house prices, Lloyds also trimmed its short-term forecasts for unemployment. Chief financial officer William Chalmers said the improved forecasts were “more about shunting the expected downturn from the end of 2020 to the beginning of 2021,” rather than avoiding economic pain.

The bank has lent £11bn to over 285,000 businesses under government COVID support schemes and provided 1.2m payment holidays to customers. Lloyds said over 80% of customers who took a payment holiday were now repaying.

READ MORE: Santander sets aside another €2.5bn to cover potential losses

Horta-Osório said the outlook remained “uncertain” due to the end of furlough, Brexit negotiations, and the prospect of a potential second lockdown.

“The economy is lately decelerating and that is why we retained our prudent approach,” he said.

Lloyds was well positioned for the future regardless, he said. The bank continues to invest aggressively in building digital services as branch usage declines.

Earlier this year, Horta-Osório announced plans to retire from the bank by next June after a decade in charge. Horta-Osório said the search for his replacement was “ongoing”, with both internal and external candidates in the running.

WATCH: What are negative interest rates?