Little-known metal palladium turns star performer as diesel declines

Palladium, a silvery metal used in catalytic converters for petrol cars, has become one of the star commodities of the year, hitting $1,000 an ounce for the first time since 2001.

The metal, mined primarily in South Africa, Zimbabwe and Russia, has risen 48pc this year, making it the best performing precious metal.

Palladium has added $70 an ounce in the last week alone, and rose 2pc in Monday morning trade in London to break the $1,000 mark.

Palladium’s strong run is linked to surging sales of petrol cars globally, in part because consumers are turning their backs on diesel vehicles.

A slew of negative publicity around diesel pollution, combined with wavering support from governments that had previously encouraged motorists to buy diesel, and the emissions data scandal that engulfed Volkswagen, has resulted in the fuel falling out of favour.

Diesel’s slide has depressed demand for palladium’s sister metal platinum, which has risen just 4.5pc this year and currently trades at around $950 an ounce. The two metals are mined together, but the latter is used mostly in diesel catalytic converters.

Last month, the palladium price exceeded platinum for the first time in 16 years. This is a rare event: according to analysis by Macquaire, the last time this happened was in 1913.

Platinum has typically commanded a premium over palladium because it is more expensive to mine and cannot be substituted for its sister metal.

Kieron Hodgson, analyst at Panmure Gordon, said palladium’s recent surge was directly connected to “the demise of the diesel engine and the resurgence of gasoline”, with forecasts predicting that the number of diesels on the road could halve in the next decade.

“Palladium is obviously seen as a winner in the new world - at least until electric vehicles come along,” he said.

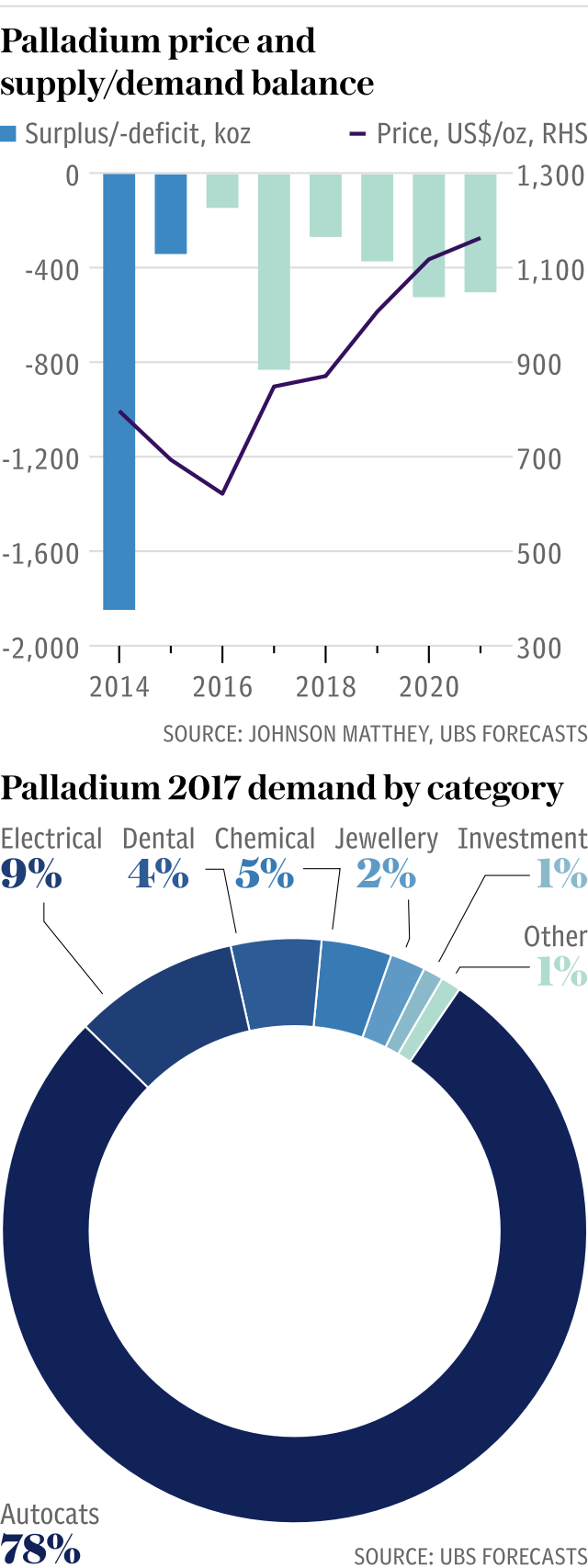

Joni Teves, analyst at UBS, suggested that a shortfall in production was also helping palladium prices. The market could hit a deficit of 830,000 ounces this year, as miners have cut back production.

“We are convinced that palladium's strength is driven by fundamentals,” she said. “Car sales in the US and China have been upbeat of late, the two key gasoline car markets that palladium is largely exposed to.”

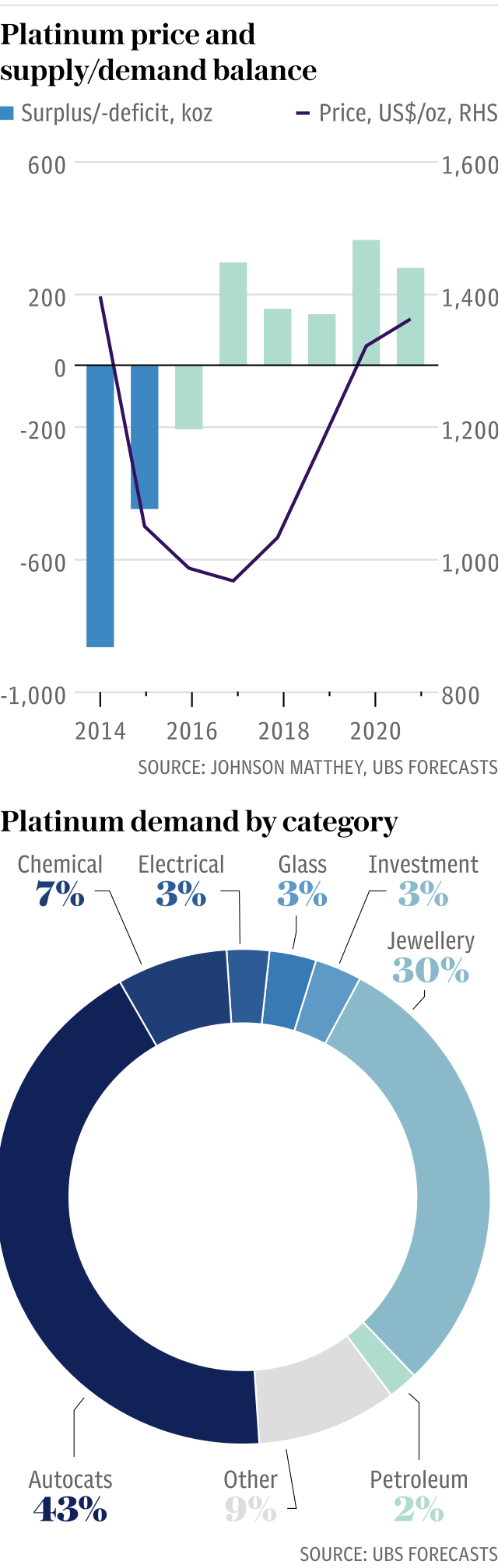

Platinum, by contrast, has largely been in oversupply, with depressed prices making life hard for miners such as London-listed Lonmin, the third-largest producer of the metal.

Shares in Lonmin rose 3.26pc in Monday morning trade, while Anglo American, another major producer of platinum group metals, climbed 1.8pc.

Many platinum group miners in South Africa - where the bulk of PGMs are mined - have been closing unprofitable shafts and attempting to introduce more automation to combat soaring costs.

John Meyer, analyst at SP Angel, said: “Marginal mine shafts have been closing at a rate of knots. We could see production in palladium and platinum continue to fall as a result of ongoing rising costs. I don’t think the current rally is enough to reverse that.”

Platinum at least has the possibility of diversification. Roughly 43pc of mined platinum is used in catalytic converters, while around 30pc goes into jewellery, and the balance split between other sectors such as electricals and chemicals.

Palladium is much more dependent on the automotive sector, with 78pc going into cars, according to UBS.

Ms Teves sounded a note of caution, saying it was unclear how much of palladium’s rise could be due to investors buying into the metal in search of profit. “The global palladium market is small and liquidity can be challenging, making prices more vulnerable to sizeable moves,” she said.

Macquarie analysts believe palladium's "moment in the sun" will eventually fade as global car sales soften. Moreover, the rise of electric vehicles could increase demand for minerals such as cobalt and lithium, but do away with the need for catalytic converters. "Without [palladium and platinum's] role in pollution control, what use do they have?" they asked.

Palladium’s rise comes as world commodities hit a six-year high, according to the Bloomberg Commodity Index. Brent crude oil touched $58 a barrel while copper climbed above $7,000 a tonne, the highest level in three years.