Elizabeth Warren's best and worst economic ideas

She’s running for president, but Elizabeth Warren may already be the nation’s wonk-in-chief.

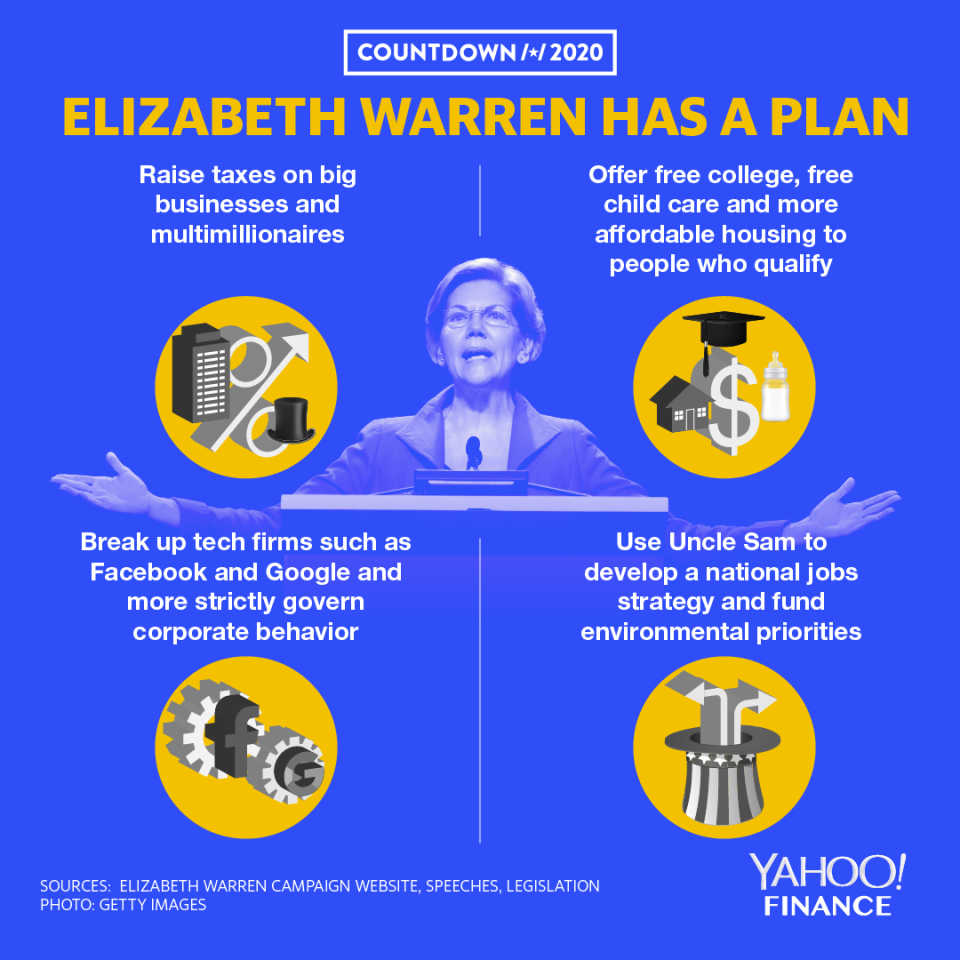

“I have a plan for that,” Warren famously declares on the campaign trail when voters ask about struggling farmers or unaffordable child care or shoddy military housing. And she really does. Her detailed policy ideas seem to be working: some polls now place the Democratic senator from Massachusetts in second place among 23 Democrats, behind only Joe Biden.

Yahoo Finance tallied 26 discrete policy plans Warren has fleshed out on her website, in speeches and in legislation she’s backing. Half relate to business and economic issues. Warren insists she’s a capitalist, yet she favors aggressive new ways to redistribute wealth, a heavy government role in the economy and other policies relatively close to the “democratic socialism” of Bernie Sanders.

Still, Warren’s ideas are framing much of the policy discussion in the 2020 campaign, to the extent there is any policy discussion this early in the race. So Yahoo Finance is grading 13 of Elizabeth Warren’s economic policy ideas, from A to F, with emphasis on workability, relevance and likely effectiveness.

The “real corporate profits tax.” Grade: B. Warren would impose a 7% tax on all corporate profits above $100 million, to raise money for other programs. She argues this is more effective than simply raising the corporate tax rate because of all the loopholes that allow big companies to evade taxes. She’s right about that. The best tax rates are the lowest ones necessary to fund the government voters want. With annual deficits approaching $1 trillion, somebody’s taxes are too low. The Trump tax cuts of 2017 cut the business tax rate by 40%, which was probably too much. Most voters would be fine with a tax hike targeting big companies that have benefited the most from globalization.

The “ultramillionaire tax.” D. Voters might also be fine with higher taxes on multimillionaires, except this tax would be a nightmare to enforce. Warren wants to impose a 2% annual tax on net worth above $50 million, and a 3% tax on wealth above $1 billion. The problem with this is determining a wealthy family’s net worth, especially with illiquid assets such as real estate, art and collectibles. Plus, imagine the clever wealth shifting such a law would incite. Better, probably, to raise other taxes such as those on capital gains or income above $250,000.

“Economic patriotism.” C. This plan is a grab-bag of ideas for using the power of the federal government to “defend and create” American jobs. Some parts make sense, such as replacing the Commerce Department and other outdated agencies with a new Department of Economic Development that would foster industrial policy similar to what Germany and Japan do. Warren would use Uncle Sam’s purchasing power to develop and sustain key industries. One dubious element is a scheme for “more actively managing our currency” to promote exports—in other words, keeping the dollar artificially weak. Government-sponsored currency manipulation: what could go wrong?

Shackle lobbyists. A. Members of Congress would never be allowed to work as lobbyists once they leave government. Foreign governments would be banned from lobbying Uncle Sam. Pentagon contractors would have to wait four years to hire military officials who retire. Such laws might face a constitutional challenge, yet they’d address what has basically become legalized corruption in the influence industry.

Universal child care. B. Warren would spend $70 billion per year, raised through the ultramillionaire tax, to offer free child care to working families earning less than 200% of the poverty limit. That threshold in 2019 would be $51,500 for a family of four. This could be a major break for lower-income parents forking over a sizable chunk of their income just so they can work. One concern is whether federal subsidies would boost demand for care so much that costs would soar for parents who don’t qualify for subsidies.

Breaking up Big Tech: D. Warren argues that Amazon, Google and Facebook have become so big that they strangle competition. Yet Google and Facebook are free, and Amazon is a consumer darling generally credited with lowering prices and innovating home delivery. It’s popular to bash Big Tech and their aggressive use of personal data, but the solution to that is new legislation regulating what companies can do with people’s personal information. Turning one big company into three or four smaller ones won’t change the use or abuse of data.

Green manufacturing. C. Warren would spend $200 billion per year to fund clean-energy research and government purchases of clean-energy products, and promote clean U.S. technology around the world. That sounds like a souped-up version of President Obama’s lackluster green-energy agenda. How about trying some market-based incentives, such as a carbon tax?

Free college, cancelling student debt. C. These are populist ideas that could have ugly consequences. Warren would first cancel up to $50,000 in student debt for anybody with household income below $100,000. Families earning more would get less relief, with the benefit ending at incomes of $250,000. That would cost $640 billion, which is roughly comparable to the entire national defense budget for 2019. Then she’d make all public colleges free to attend, costing another $62 billion per year. Investing in education does generate strong returns, but this could be another instance where a surge in federal subsidies swells demand, eroding quality and driving up tuition at private universities. It would also reduce or kill the incentive for families to spend education dollars carefully. There are other ideas such as apprenticeships, co-ops, job and salary guarantees and income-sharing agreements to help students out without putting the entire burden on taxpayers.

Closing the “entrepreneurship gap.” B. This plan would allot $7 billion per year for grants to minority-owned startups, to address a large gap in the financing available to white- and minority-owned businesses. It’s a relatively small amount of money, and since they’d be grants rather than loans, there’d be nothing to pay back. Free money, on the other hand, doesn’t necessarily teach financial discipline.

Making CEOs criminally liable. C. Like many Americans, Warren is frustrated that no bank CEOs went to jail after the financial crash in 2008. So she wants to pass a new law that would make executives at large corporations criminally liable of negligence if their companies committed violations that harmed at least 1% of the U.S. population. Such a law might have put former Equifax CEO Richard Smith in prison. Thing is, there are already laws prohibiting criminal behavior by CEOs—and it’s not a crime to be incompetent. A better solution might be hiring more aggressive prosecutors and enforcement honchos at agencies such as the Securities and Exchange Commission.

More affordable housing. B. This is one area where Warren wants to slash regulation—such as cumbersome local zoning laws that inhibit construction—rather than adding more. She’d spend $50 billion per year to rehab existing affordable housing, build new units and give localities financial incentives to make it easier to build. There’d be tie-ins with private investors, making the program more efficient, in theory. Warren says adding to the supply of housing would reduce rents 10%. That sounds facile, but the shortage of affordable housing is a legitimate problem in many areas.

Let the federal government manufacture generic drugs. D. Warren sponsors legislation under which the Department of Health and Human Services would produce generics when there’s no affordable version of a drug on the market. Maybe the government should get the money-losing postal service turned around before breaking into other businesses. Warren does favor letting Medicare negotiate drug prices with manufacturers, a sounder tactic for lowering prices.

Enhance Obamacare en route to Medicare for all. C. If we were grading these items separately, we’d give Warren an B+ for her proposed fixes to Obamacare and an F for Medicare for all, which is a prohibitively expensive pipe dream. The Obamacare fix would expand subsidies to help people who don’t get coverage through an employer and who earn too much to qualify for Obamacare subsidies, who get gouged for insurance when they buy an individual policy. That’s a badly needed patch. Medicare for all, on the other hand, would kill the private insurance millions of Americans are happy with and cause unimaginable disruption as everybody transitioned into a huge government plan. Better to build on Obamacare with a new public option that leaves private insurance intact but offers relief for those under 65 not covered by an employer. Some other Democrats have a plan for that.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Meet the 2020 presidential candidates

How China could meddle in the 2020 election

Trump has no choice but to land a trade deal with China

Your paltry savings from the Trump tax cuts

Medicare for all won’t work. This might

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Read the latest financial and business news from Yahoo Finance