Borrowing and lending between friends and family plummets

Borrowing and lending money between friends and family has plummeted in the past year, falling even further following the coronavirus lockdown.

There has been a 58% reduction in borrowing, and a 52% decrease in lending, since March 2019, according to the latest ‘How Britain Lives’ research from Lloyds Bank.

Borrowing significant sums of money from loved ones decreased by 29% in the year to March 2020, and then by a further 40% throughout lockdown.

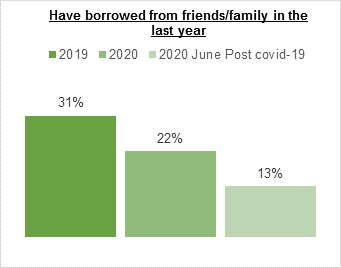

Just 13% of Brits have borrowed money from friends or family in the last year, compared to 31% in March 2019.

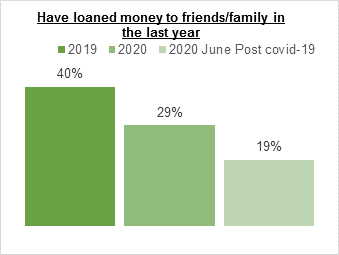

Lending has seen a similar decline with a 28% reduction in the loaning of money to loved ones between March 2019 and March 2020. Lending went down by a further 34% over the lockdown period.

The number of people lending money to friends and family has more than halved in the last year, falling to 19% from 40% in March 2019.

READ MORE: Millions of Brits could pay more for borrowing due to COVID-19 credit score damage

The main reason for borrowing money from friends or family was to pay off other debts, with 16% of people citing this as the reason.

Buying a car was the second most common reason for borrowing (14%) and the biggest loans from family and friends in the past year were for cars, with the average loan standing at £3,630.

People also borrowed substantial sums to pay for weddings, borrowing an average £3,226.

Some 12% of people called on loved ones for extra cash to make home improvements, at an average of £2,846.

The average amount borrowed for debt consolidation was £2,563.

READ MORE: UK shoppers plan to spend £9.3bn on post-lockdown treats

Family and friends who have been lending money are much less likely to be happy about doing so, with just 51% saying they were pleased to be able to help someone out, compared to 61% in 2019, and fewer people expect to be paid back than in 2019 — 42% compared to 43%.

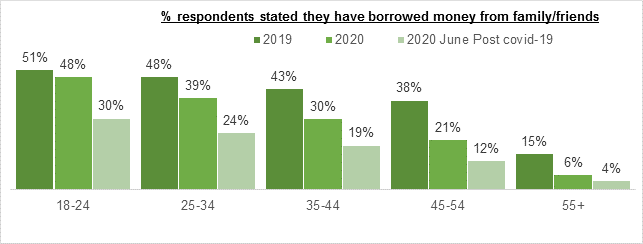

Those aged between 18 and 24 are the most likely to lean on friends and family for extra cash, but borrowing amongst this group has dropped from over half (51%), to one in three (30%). Across all age groups there has been a significant drop in people turning to loved ones for financial aid.

Those in Wales are the least likely to borrow money from loved ones, with only 5% saying they have done so in the last year, an 83% reduction since 2019. The regions seeing the most borrowing from friends and family are the South West, and the North West, where 15% continue to lean on loved ones for financial support.