Arcadia's rivals cheer as TopShop owner nears collapse

Shares in publicly traded UK retail businesses rose on Monday, boosted by news that Arcadia was on the brink of collapse.

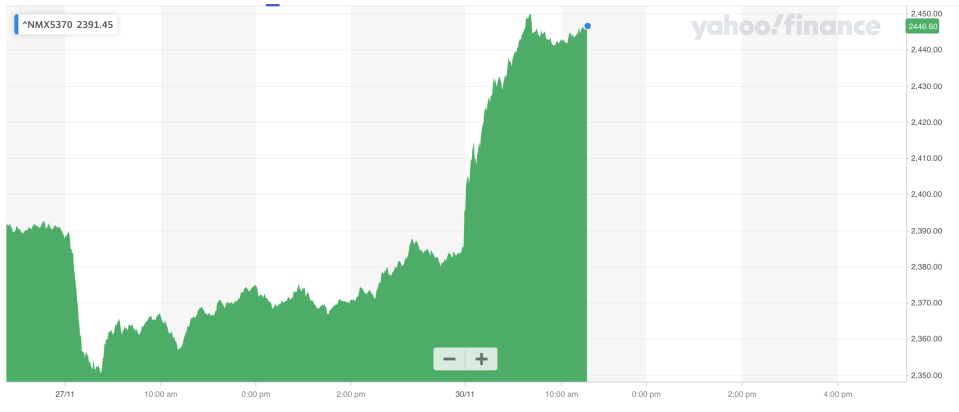

The FTSE 350 general retail index (^NMX5370) was up almost 2% on Monday morning. The rise came amid reports that Arcadia, the group behind brands like TopShop, Dorothy Perkins, and Miss Selfridge, was hours away from filing for administration.

If Arcadia does collapse, fashion retailers will face less competition and could even expand their business by buying parts of Arcadia on the cheap.

Administration — a form of bankruptcy — would pave the way for store closures and job losses. Arcadia operates over 500 stores across the UK and employs more than 13,000 people.

“With chances high that there will be one less major competitor on the high street, shares in Marks and Spencer and Next have lifted amid hopes they could lure customers through their doors instead,” said Susannah Streeter, senior investment and markets analyst at stockbroker Hargreaves Lansdown.

Shares in Next (NXT.L) rose 2%, while Marks & Spencer (MKS.L) gained 2.3%.

READ MORE: TopShop-owner Arcadia could enter administration 'within hours'

Administration would also pave the way for Arcadia’s sale. Analysts said the group would likely be broken up.

“Arcadia is a bit like an old car — there are lots of assets under the bonnet that are very good and work quite well,” said Richard Hyman, a retail industry analyst. “With the right leadership and the right ownership you could squeeze a bit more out of it.”

Hyman said there would be “no shortage of suitors” for TopShop and said other Arcadia brands would be “ripe for someone like Boohoo”. Boohoo (BOO.L) stock gained 3.8%.

Frasers Group (FRAS.L), the retail conglomerate owned by billionaire Mike Ashley, said publicly on Monday it would take part in any Arcadia sale process. The company has also offered Arcadia a £50m loan to stave off collapse.

Frasers was a notable under performer in the retail sector. Stock in the company, which owns Sports Direct, was down half a percent.

“Mike Ashley has already been on an expansion drive this year, buying into Hugo Boss and increasing the company’s stake in Mulberry, so there is some concern about whether Frasers Group can afford to go on another shopping spree right now,” said Streeter.

READ MORE: Arcadia troubles threaten Debenhams-JD Sports rescue talks

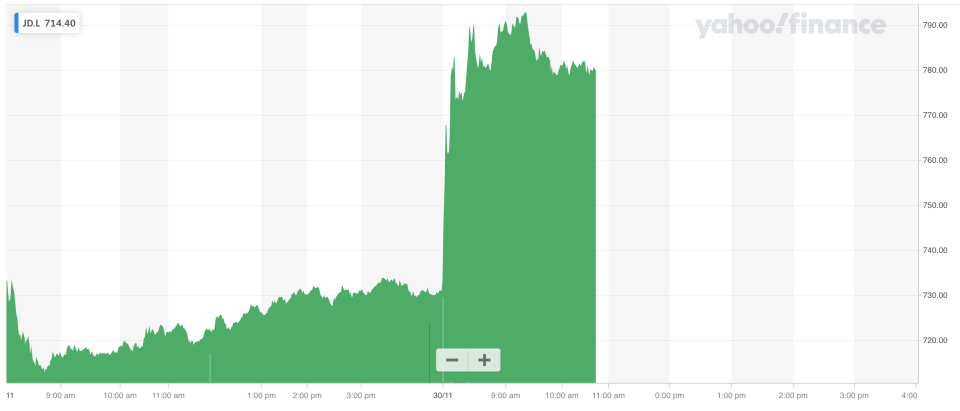

JD Sports (JD.L) was the best performing stock on the FTSE 100, up 6.6%. The rise came amid reports that the athletics retailer could walk away from deal talks with Debenhams. The fate of the department store, which is in administration itself, is linked to Arcadia.

“The Arcadia stable has store concessions inside Debenhams,” Shore Capital’s retail analyst team wrote in a note. “It is our view that Arcadia represents c5% of Debenham’s revenues c£80m, so the Arcadia ownership potentially needs to be resolved, as part of the current Debenhams takeover talks.”

Russ Mould, investment director at stockbroker AJ Bell, said the jump in JD Sports’ share price “reflects market perception of the risks attached to this transaction.”

Watch: Why UK tax hikes may seem inevitable