Brexit, US elections, and trade war leave investors glued to politics in 2020

All eyes will be on politics in 2020, as nervous investors try to spot tripwires that could derail the slowing global stock rally.

“Political choices will be a key driver of market performance in 2020,” Dean Turner, UK economist at UBS, said in a recent note to clients. “The trouble is that they are exceptionally difficult to predict and price.”

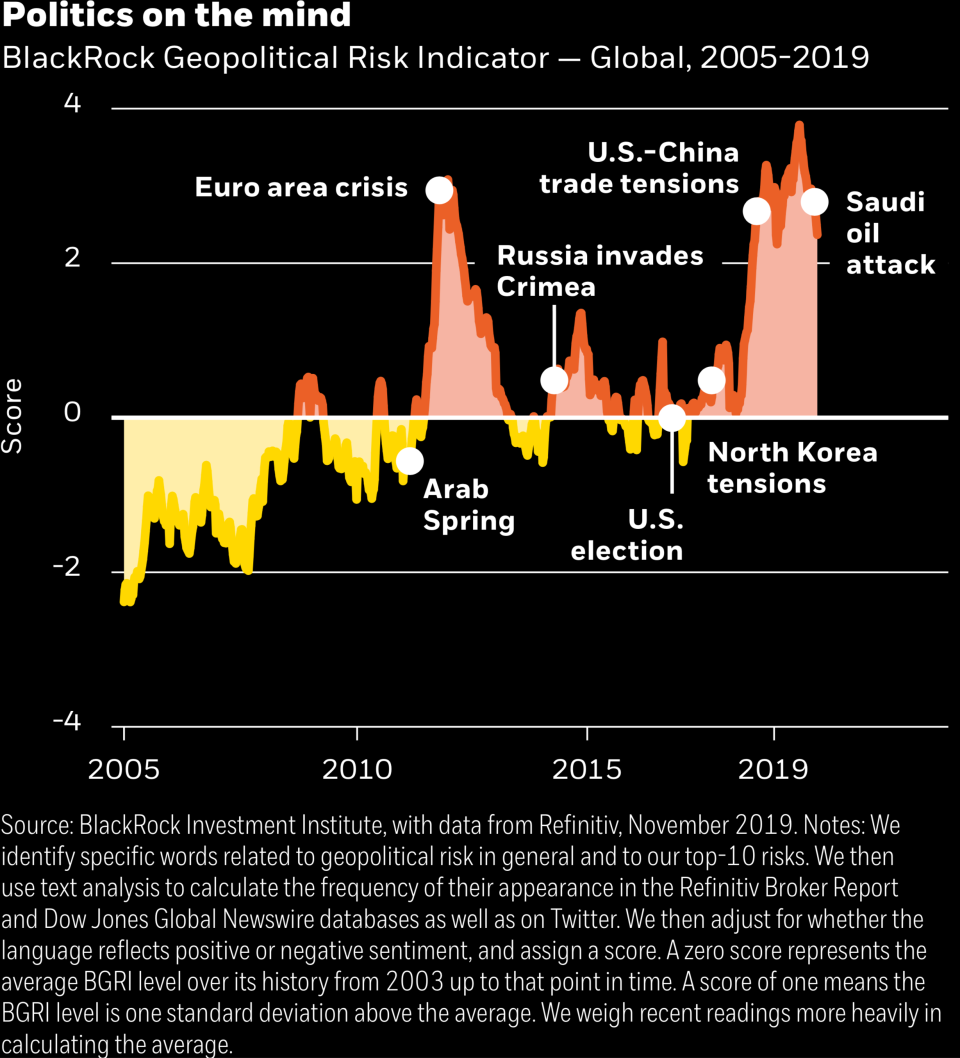

Geopolitical tensions have risen to levels not seen since the 2012 Eurozone crisis, according to BlackRock Investment Institute, and are likely to remain elevated in 2020.

November brings the US presidential elections, which are likely to dominate attention for much of the year. The impeachment of US President Donald Trump also rumbles on.

On the other side of the Atlantic, Brexit is set to move into the next stage of negotiations between the UK and EU. The pound will be as sensitive to trade talk developments as it was to the progress of withdrawal agreement negotiations.

In the background, trade tensions continue between the US and China. A ‘Phase One’ agreement between the two side is set to be signed in January but talks will then move on to ‘Phase Two’. Negotiations are likely to be as fraught as they were in the first stage.

All of these events could potentially derail what BNP Paribas Asset Management calls a “fragile goldilocks” global economy — “a supportive ‘not too hot and too cold’ mix of growth and inflation, where monetary policy is easy.”

To put it all another way, the champagne is still flowing but investors are nervously glancing at the bar expecting last orders to be called.

Any escalation in the US-China trade war could tip things over the edge. Similarly, an unexpected turn for Brexit or in the US elections could send investors fleeing to safety.

Other flash points include ongoing protests in Hong Kong, flaring tensions in the Middle East, the Turkish push into Syria, and potential political action to rein in ‘Big Tech’.

“We expect market attention to geopolitical risks to remain high in 2020 even as we see US-China trade tensions likely extending their temporary pause,” the team at the BlackRock Investment Institute wrote in its 2020 Global Outlook.

However, politics is not all bad for investors in 2020. Politicians could provide a boost to global growth and stock prices in the form of government spending.

“My motto for 2020 would be: it’s mostly fiscal,” Romain Boscher, global chief investment officer for equites at Fidelity, wrote. “We are probably underestimating the fiscal room for manoeuvre in China and the US, while central bankers in Japan and Europe are both telling their states to spend more.”

The UK is set to see a big increase in government spending, which could provide a boost to the economy. Opinion is also growing that surplus-loving Germany may also dip into its reserves and start spending to boost stuttering local growth.

“For markets, the debate will move away from monetary policy and focus much more on fiscal policy,” Elga Bartsch, head of macro research at the BlackRock Investment Institute, told journalists at a recent 2020 outlook event.