Q&A: what Cameron's tax pledge means for you

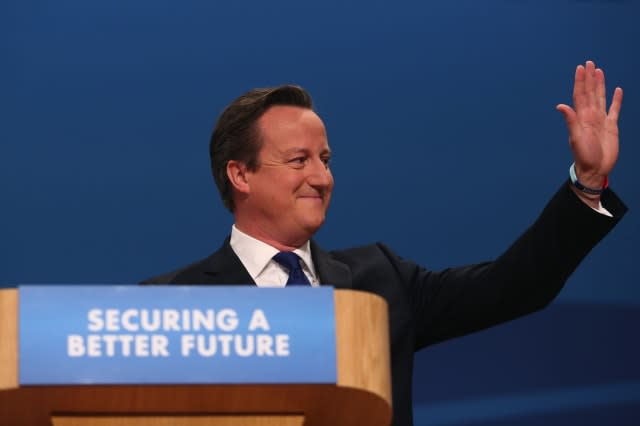

The Prime Minister has pledged to ease the tax burden for around 30 million people if the Conservatives win next year's election.

What has David Cameron promised will happen if he is re-elected in 2015?

He has said that the Conservatives will increase the rate at which workers pay the higher 40p rate of income tax to £50,000.

At the moment, anyone earning more than £41,900 is taxed at 40%, meaning many people in jobs which would be considered "middle income" have found themselves pulled into this higher tax bracket.

Furthermore, the Conservatives plan to raise the level of the tax-free personal allowance to £12,500. The current tax-free personal allowance is £10,000.

When will these new thresholds be put in place?

%VIRTUAL-ArticleSidebar-tax%

A £12,500 personal allowance and a £50,000 higher rate threshold will be delivered by April 2020 "at the latest".

The thresholds would edge up gradually between 2015 and 2020 to get to this point and would not necessarily increase in uniform steps each year as other factors such as the state of the economy would also need to be taken into account.

In 2010, the personal allowance was £6,475, so in the space of a decade it will have almost doubled, according to the plans.

What would happen if the proposed new thresholds were not put in place?

The personal allowance is set to rise to £10,500 in April 2015. After that, on the basis of existing government policy of uprating the threshold in line with Consumer Price Index (CPI) inflation, it would reach around £11,620 by April 2020.

The higher rate threshold is due to increase to £42,285 next April. After that, if it increased in line with inflation it would reach around £46,920 by April 2020.

How many people do the Conservatives say would benefit from their plans?

They have put the figure at 30 million, the vast majority of whom will be basic rate taxpayers.

They say that by April 2020, a typical basic rate tax payer will pay £500 less in tax than they do today. Meanwhile, someone who pulls in a wage of between £50,000 to £100,000 will pay £1,313 less in tax than they do now.

Lifting the higher rate threshold would take around 800,000 people out of 40% tax.

And around one million people would be lifted out of tax altogether by increasing the personal allowance to £12,500.

A £12,500 personal allowance would mean that no-one working 30 hours a week on the minimum wage, assuming it is £8 in 2020 on the basis of current projections, will pay income tax, the Conservatives say.

Article continues below

So, with so many people expected to be better off as a result of the plans, how much is this going to cost? And who's going to pick up the tab?

The cost of increasing the personal allowance to £12,500 by 2020 has been put at £5.6 billion, while the cost of increasing the higher rate threshold to £50,000 by 2020 has been put at £1.6 billion, making a combined cost of £7.2 billion.

The Conservatives have not identified a particular area where the money would come from, although they have said that their track record of efficient spending this Parliament has demonstrated that they can cut the deficit and taxes.

What reaction have the plans had?

The plans are expected to get a warm welcome from taxpayers, but some experts believe the measures will make the job of steering the economy along the road to recovery more challenging.

Anita Monteith, tax manager at the Institute of Chartered Accountants in England and Wales (ICAEW), said: "These proposed tax cuts will appeal to both low and middle income earners.

"Raising the 40% threshold to £50,000 makes it much simpler for people to understand too.

"But if implemented, these measures will make it harder to cut the deficit by 2018 if wage growth continues to be constrained. Our recent forecast has shown that wages are expected to grow by only 1.3% in 2014, so this will be a challenging task."

Research director of the Adam Smith Institute, Sam Bowman, described the pledge as "great news", saying: "Tax cuts for the poor are one of the best ways to help beat poverty in Britain.

"Taking minimum wage workers out of tax is a way of giving workers a 'living wage' without risking jobs. The difference between the living wage and the minimum wage is entirely tax - if we stopped taxing minimum wage workers, they would earn the equivalent to a post-tax living wage."

Mark Littlewood, director general at the Institute of Economic Affairs, said Mr Cameron should also look to end the "pernicious" effects that other taxes, such as stamp duty, have had on ordinary people.

Tax stories on AOL Money

How much tax do you pay? Is this fair?

eBay pays just £620,000 tax on £1.3bn sales

The UK is a 'tax haven', whether we like it or not